Regulatory Support

Regulatory support is emerging as a key driver for the Ethylene Vinyl Alcohol Copolymer Market. Governments worldwide are implementing stringent regulations aimed at reducing plastic waste and promoting the use of sustainable materials. These regulations often favor the adoption of materials like EVOH, which are known for their environmental benefits. As a result, manufacturers are increasingly turning to EVOH to comply with these regulations and to enhance their product offerings. The regulatory landscape is expected to evolve, with more countries adopting policies that encourage the use of biodegradable and recyclable materials. This shift is likely to create new opportunities for growth within the Ethylene Vinyl Alcohol Copolymer Market, as companies seek to align their products with regulatory requirements.

Diverse Applications

The versatility of ethylene vinyl alcohol copolymer is a significant driver for the Ethylene Vinyl Alcohol Copolymer Market. EVOH is utilized across a wide range of applications, including food packaging, pharmaceuticals, and automotive components. Its exceptional barrier properties against gases and moisture make it an ideal choice for preserving the freshness of food products, which is increasingly important in today's market. Furthermore, the automotive industry is adopting EVOH for fuel systems and other components due to its lightweight and durable characteristics. Recent estimates indicate that the food packaging segment alone accounts for over 40% of the total demand for EVOH, underscoring the material's critical role in various sectors and its potential for continued growth in the Ethylene Vinyl Alcohol Copolymer Market.

Sustainability Focus

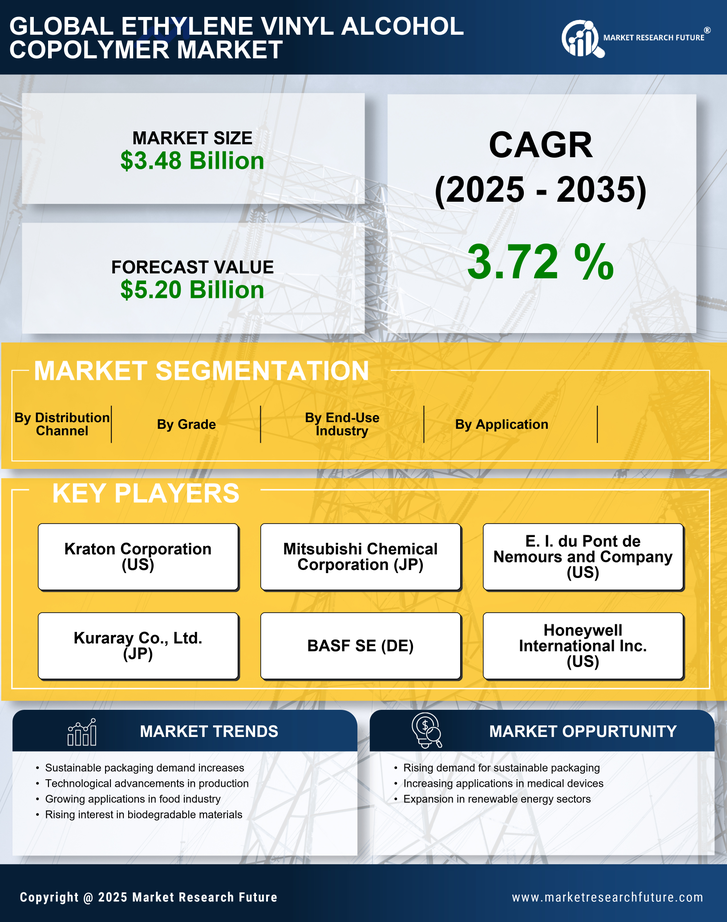

The Ethylene Vinyl Alcohol Copolymer Market is experiencing a notable shift towards sustainability, driven by increasing environmental awareness among consumers and manufacturers. This trend is reflected in the growing demand for eco-friendly materials that can replace traditional plastics. Ethylene vinyl alcohol copolymer (EVOH) is recognized for its biodegradable properties and ability to reduce carbon footprints, making it an attractive option for packaging and other applications. As companies strive to meet regulatory requirements and consumer expectations for sustainable products, the market for EVOH is projected to expand. Recent data indicates that the demand for sustainable packaging solutions is expected to grow at a compound annual growth rate of over 5% in the coming years, further bolstering the Ethylene Vinyl Alcohol Copolymer Market.

Rising Consumer Demand

Rising consumer demand for high-quality and sustainable products is significantly influencing the Ethylene Vinyl Alcohol Copolymer Market. As consumers become more discerning about the materials used in products, there is a growing preference for packaging solutions that offer both functionality and environmental benefits. Ethylene vinyl alcohol copolymer, with its superior barrier properties and eco-friendly profile, is increasingly favored by manufacturers looking to meet these consumer expectations. Market Research Future indicates that the demand for high-performance packaging materials is projected to grow at a rate of approximately 6% annually, reflecting the shift in consumer preferences. This trend is likely to drive further innovation and investment in the Ethylene Vinyl Alcohol Copolymer Market, as companies strive to develop products that resonate with environmentally conscious consumers.

Technological Advancements

Technological advancements play a crucial role in shaping the Ethylene Vinyl Alcohol Copolymer Market. Innovations in production techniques and material formulations have led to enhanced properties of EVOH, such as improved barrier performance and thermal stability. These advancements enable manufacturers to create more efficient and effective products, catering to diverse applications in food packaging, automotive, and medical sectors. The introduction of new processing technologies, such as extrusion and injection molding, has also facilitated the integration of EVOH into various products. Market data suggests that the adoption of advanced manufacturing processes is likely to increase the overall production capacity of EVOH, thereby driving growth in the Ethylene Vinyl Alcohol Copolymer Market.