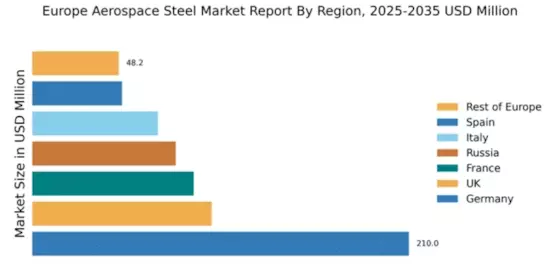

Germany : Strong industrial base and innovation

Key markets include cities like Hamburg, known for its aerospace cluster, and Munich, home to major manufacturers. The competitive landscape features prominent players like Thyssenkrupp and Airbus, which dominate the local market. The business environment is characterized by strong collaboration between industry and academia, fostering innovation. The aerospace sector is particularly focused on commercial aircraft and defense applications, driving demand for high-quality steel products.

UK : Innovation and investment drive demand

Key markets include regions like the West Midlands and South East England, which host major aerospace manufacturers. The competitive landscape features companies like Rolls-Royce and BAE Systems, which significantly influence local dynamics. The business environment is favorable, with strong government support for aerospace initiatives. The sector is heavily involved in both commercial and military applications, enhancing the demand for specialized steel products.

France : Home to major aerospace manufacturers

Key markets include Toulouse, the heart of Airbus operations, and Paris, which hosts numerous aerospace suppliers. The competitive landscape is dominated by major players, including Alcoa and Safran, which shape market dynamics. The business environment is characterized by strong collaboration between industry and research institutions. The aerospace sector focuses on commercial aviation and space applications, driving demand for specialized steel solutions.

Russia : Focus on defense and aviation sectors

Key markets include Moscow and Kazan, which are central to Russia's aerospace industry. The competitive landscape features local players like United Aircraft Corporation, which significantly influence market dynamics. The business environment is improving, with government initiatives aimed at fostering innovation. The aerospace sector is heavily focused on military aircraft and space exploration, driving demand for high-performance steel products.

Italy : Strong industrial base and innovation

Key markets include Turin and Naples, which are hubs for aerospace manufacturing. The competitive landscape features companies like Leonardo and Alenia Aermacchi, which play significant roles in the local market. The business environment is characterized by strong government support for aerospace initiatives. The sector is focused on both commercial and defense applications, enhancing the demand for specialized steel products.

Spain : Investment in innovation and infrastructure

Key markets include Madrid and Seville, which host major aerospace manufacturers. The competitive landscape features companies like Airbus and Aernnova, which significantly influence local dynamics. The business environment is favorable, with strong government support for aerospace initiatives. The sector is heavily involved in commercial aviation and space exploration, driving demand for specialized steel solutions.

Rest of Europe : Emerging markets and opportunities

Key markets include countries like Poland and Hungary, which are developing their aerospace industries. The competitive landscape features a mix of local and international players, creating a dynamic business environment. The sector is focused on both commercial and military applications, enhancing the demand for specialized steel products. Collaboration between industry and academia is fostering innovation and growth in the region.