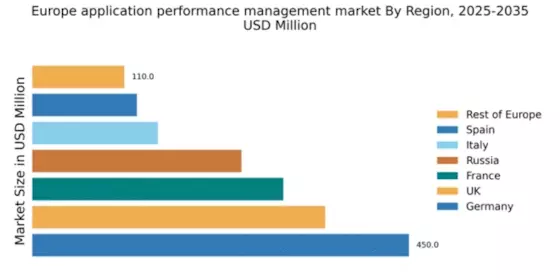

Germany : Strong Growth Driven by Innovation

Germany holds a commanding 30% market share in the application performance management sector, valued at $450.0 million. Key growth drivers include a robust digital transformation agenda, increasing cloud adoption, and a focus on enhancing user experience. Demand trends indicate a shift towards AI-driven solutions, while government initiatives support tech innovation through funding and regulatory frameworks. The country's advanced infrastructure and industrial base further bolster market growth.

UK : Innovation and Competition Thrive

The UK market accounts for 25% of the European application performance management sector, valued at $350.0 million. Growth is fueled by a strong emphasis on cybersecurity and data privacy regulations, alongside increasing demand for real-time analytics. The competitive landscape is vibrant, with London and Manchester emerging as key hubs for tech startups and established firms alike. Local players like Micro Focus and international giants like IBM are significant contributors to market dynamics.

France : Focus on Digital Transformation

France captures 20% of the market share, valued at $300.0 million, driven by a national push for digital transformation across industries. Key growth factors include government initiatives promoting tech innovation and a rising demand for integrated solutions. Cities like Paris and Lyon are pivotal markets, showcasing a blend of startups and established firms. Major players such as Dynatrace and AppDynamics are actively expanding their presence, enhancing the competitive landscape.

Russia : Growth Amidst Regulatory Challenges

Russia holds a 17% market share, valued at $250.0 million, with growth driven by increasing digitalization in various sectors. However, regulatory challenges and geopolitical factors pose risks. Demand for application performance management is rising, particularly in Moscow and St. Petersburg, where tech adoption is accelerating. Local players are emerging, but international firms like Datadog and Splunk maintain a strong foothold, navigating the complex market dynamics.

Italy : Focus on Industrial Applications

Italy represents 10% of the market, valued at $150.0 million, with growth driven by the manufacturing sector's digital transformation. Key cities like Milan and Turin are central to this trend, as industries seek to enhance operational efficiency. The competitive landscape includes both local and international players, with firms like SolarWinds gaining traction. Government initiatives supporting digital innovation further bolster market potential, creating a favorable business environment.

Spain : Innovation and Investment Surge

Spain accounts for 8% of the market share, valued at $125.0 million, with significant growth driven by increased investment in technology and innovation. Cities like Barcelona and Madrid are becoming tech hubs, attracting startups and established firms alike. The competitive landscape features both local and international players, with a focus on sectors like e-commerce and finance. Government support for digital initiatives enhances the market's attractiveness and growth potential.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe holds a 6% market share, valued at $110.0 million, characterized by diverse market conditions and varying growth rates. Key drivers include localized demand for application performance management solutions tailored to specific industries. Countries like Belgium and the Netherlands are notable markets, with a mix of local and international players. The competitive landscape is fragmented, with firms adapting to regional needs and regulatory environments, creating unique challenges and opportunities.