Expansion of End-Use Industries

The expansion of end-use industries such as packaging, textiles, and personal care is significantly influencing the aromatics market in Europe. The packaging industry, in particular, is experiencing robust growth, driven by the increasing demand for sustainable and innovative packaging solutions. Aromatic compounds are essential in producing various packaging materials, which are projected to grow at a CAGR of around 3.8% through 2030. Additionally, the textile industry is also evolving, with a growing preference for synthetic fibers that utilize aromatic compounds. This trend indicates a potential increase in the consumption of aromatics, thereby positively impacting the market. The personal care sector, with its continuous innovation in fragrance and formulation, further contributes to the demand for aromatic compounds, suggesting a multifaceted growth trajectory for the aromatics market.

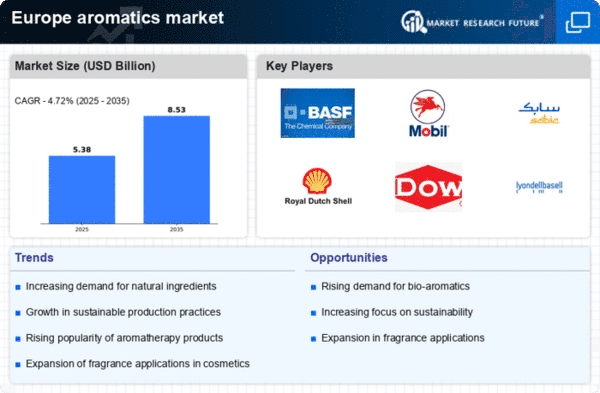

Shift Towards Bio-Based Aromatics

The shift towards bio-based aromatics is emerging as a crucial driver for the aromatics market in Europe. As sustainability becomes a priority, many manufacturers are exploring renewable sources for aromatic compounds. This transition is likely to be supported by various government initiatives aimed at promoting green chemistry and reducing reliance on fossil fuels. The bio-based chemicals market is anticipated to grow at a CAGR of approximately 5% from 2025 to 2030, indicating a strong potential for bio-based aromatics. This shift not only aligns with environmental goals but also opens new avenues for innovation in product development. Consequently, the aromatics market may witness a transformation as companies adapt to these changes, potentially leading to a more sustainable and diversified product portfolio.

Rising Demand for Specialty Chemicals

The increasing demand for specialty chemicals in various industries is a notable driver for the aromatics market in Europe. Industries such as automotive, construction, and consumer goods are increasingly utilizing aromatic compounds for their unique properties. For instance, the market for specialty chemicals is projected to grow at a CAGR of approximately 4.5% from 2025 to 2030. This growth is likely to enhance the demand for aromatics, as they serve as key intermediates in the production of these chemicals. Furthermore, the shift towards high-performance materials in manufacturing processes is expected to further bolster the aromatics market, as manufacturers seek to improve product quality and performance. As a result, the aromatics market is poised to benefit from this trend, with potential revenue growth opportunities in the coming years.

Technological Innovations in Production Processes

Technological innovations in production processes are playing a pivotal role in shaping the aromatics market in Europe. Advancements in catalytic processes and extraction techniques are enhancing the efficiency and yield of aromatic compounds. For instance, the implementation of advanced catalytic technologies can improve production efficiency by up to 20%, thereby reducing operational costs. Moreover, the integration of automation and digitalization in manufacturing processes is likely to streamline operations and enhance product quality. These innovations not only contribute to cost-effectiveness but also support compliance with stringent environmental regulations. As a result, the aromatics market is expected to benefit from these technological advancements, potentially leading to increased competitiveness and market share for key players.

Growing Consumer Preference for Natural Fragrances

The growing consumer preference for natural fragrances is significantly impacting the aromatics market in Europe. As consumers become more health-conscious and environmentally aware, there is a noticeable shift towards products that contain natural and organic ingredients. This trend is particularly evident in the personal care and cosmetics sectors, where the demand for natural fragrances is on the rise. The market for natural fragrances is projected to grow at a CAGR of around 6% from 2025 to 2030, indicating a robust opportunity for aromatic compounds derived from natural sources. This shift not only reflects changing consumer preferences but also encourages manufacturers to innovate and reformulate their products. Consequently, the aromatics market is likely to experience a transformation as it adapts to these evolving consumer demands.