Germany : Innovation and Investment Drive Growth

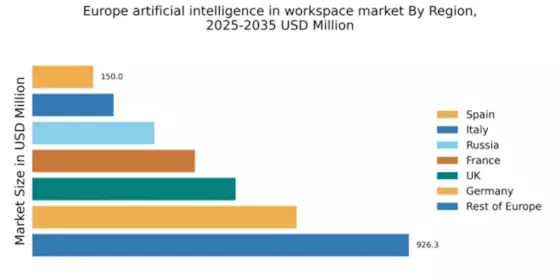

Germany holds a dominant position in the AI-in-workspace market, accounting for approximately 25% of the total European market with a value of $650.0 million. Key growth drivers include robust investment in R&D, a strong industrial base, and government initiatives promoting digital transformation. Demand for AI solutions is rising, particularly in manufacturing and automotive sectors, supported by favorable regulatory policies aimed at fostering innovation and infrastructure development.

UK : Strong Demand Across Sectors

The UK AI-in-workspace market is valued at $500.0 million, representing about 20% of the European market. Growth is driven by increasing adoption of AI technologies in finance, healthcare, and retail sectors. The UK government has implemented various initiatives to support AI development, including funding for startups and research projects. The demand for AI solutions is also influenced by the need for enhanced productivity and efficiency in businesses.

France : Government Support Fuels Growth

France's AI-in-workspace market is valued at $400.0 million, capturing around 16% of the European market. Key growth drivers include government-backed initiatives like the AI for Humanity strategy, which promotes AI research and development. The demand for AI solutions is particularly strong in the tech and service sectors, with a focus on enhancing customer experience and operational efficiency. Regulatory frameworks are evolving to support innovation while ensuring ethical standards.

Russia : Potential for Rapid Growth

Russia's AI-in-workspace market is valued at $300.0 million, accounting for about 12% of the European market. The growth is driven by increasing investments in technology and a growing interest in AI applications across various sectors, including energy and telecommunications. Government initiatives aimed at digital transformation and infrastructure development are also contributing to market expansion. However, regulatory challenges remain a concern for foreign investments.

Italy : Focus on Manufacturing and Services

Italy's AI-in-workspace market is valued at $200.0 million, representing about 8% of the European market. The growth is primarily driven by the manufacturing and services sectors, where AI is being integrated to improve efficiency and reduce costs. Government initiatives, such as the National Plan for Industry 4.0, are fostering innovation and investment in AI technologies. The competitive landscape includes both local startups and established global players.

Spain : Rising Demand in Key Sectors

Spain's AI-in-workspace market is valued at $150.0 million, making up about 6% of the European market. The growth is fueled by increasing demand for AI solutions in sectors like tourism, finance, and healthcare. Government support through funding and initiatives aimed at digital transformation is enhancing the business environment. Major cities like Madrid and Barcelona are emerging as key hubs for AI innovation and investment.

Rest of Europe : Varied Growth Opportunities

The Rest of Europe accounts for a significant market share of $926.29 million, driven by diverse economic conditions and varying levels of AI adoption. Countries like the Netherlands and Sweden are leading in AI innovation, supported by strong government policies and investment in technology. The competitive landscape is characterized by a mix of local and international players, with applications spanning multiple sectors, including finance, healthcare, and logistics.