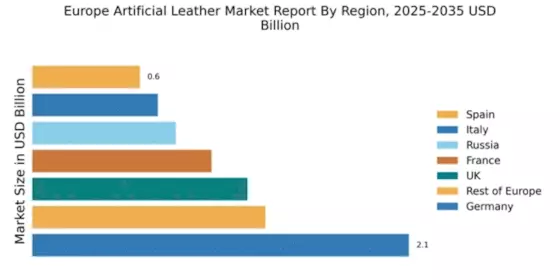

Germany : Innovation Drives German Market Growth

Germany holds a dominant market share of 2.1 in the European artificial leather sector, driven by robust automotive and fashion industries. The demand for sustainable materials is increasing, supported by government initiatives promoting eco-friendly production. Regulatory policies favoring reduced carbon footprints are also influencing consumption patterns, while advanced infrastructure facilitates efficient manufacturing processes.

UK : Sustainability Fuels UK Market Expansion

The UK market accounts for 1.2 of the European artificial leather share, with a growing emphasis on sustainable alternatives. Consumer demand is shifting towards eco-friendly products, driven by awareness of environmental issues. Government policies supporting green initiatives and investments in research and development are key growth drivers, alongside a strong retail sector that embraces innovative materials.

France : Luxury and Sustainability Converge

France, with a market share of 1.0, is characterized by its strong fashion industry, which significantly influences artificial leather demand. The trend towards sustainable luxury is reshaping consumption patterns, with brands increasingly opting for eco-friendly materials. Regulatory frameworks promoting sustainability in textiles are also in place, enhancing the market's growth potential.

Russia : Industrial Applications Drive Growth

Russia's artificial leather market, holding a share of 0.8, is witnessing growth driven by diverse applications in automotive, furniture, and fashion industries. The demand for affordable and durable materials is rising, supported by local manufacturing initiatives. Government policies aimed at boosting domestic production are also contributing to market expansion, alongside increasing urbanization.

Italy : Artistry Meets Functionality

Italy, with a market share of 0.7, showcases a unique blend of artistry and functionality in artificial leather applications. The fashion and automotive sectors are key drivers, with a growing preference for high-quality, sustainable materials. Regulatory support for eco-friendly practices is evident, fostering innovation and enhancing the competitive landscape in this culturally rich market.

Spain : Versatility Fuels Spanish Growth

Spain's artificial leather market, accounting for 0.6, is characterized by its versatility across various sectors, including fashion, automotive, and upholstery. The demand for innovative and sustainable materials is on the rise, supported by government initiatives promoting green technologies. Key cities like Barcelona and Madrid are central to market activities, enhancing the competitive landscape.

Rest of Europe : Regional Variations in Demand

The Rest of Europe holds a market share of 1.3, reflecting diverse consumer preferences and industrial applications. Countries in this category are increasingly adopting artificial leather for automotive, fashion, and furniture sectors. Local regulations promoting sustainability are influencing market dynamics, while varying economic conditions shape demand trends across different regions.