Shift Towards Autonomous Vehicles

The automotive position-sensors market in Europe is significantly impacted by the ongoing shift towards autonomous vehicles. As the automotive industry moves towards higher levels of automation, the demand for precise and reliable position sensors becomes increasingly critical. These sensors are integral to the functioning of autonomous systems, providing essential data for navigation, obstacle detection, and vehicle control. Recent projections suggest that the autonomous vehicle market in Europe could reach €50 billion by 2030, underscoring the potential for growth in the automotive position-sensors market. This shift indicates a transformative change in vehicle technology, where the reliance on advanced position sensing will be paramount for the successful deployment of autonomous driving solutions. Consequently, the automotive position-sensors market is likely to experience substantial growth as manufacturers adapt to this evolving landscape.

Increased Focus on Safety Features

The automotive position-sensors market in Europe is significantly influenced by the heightened emphasis on safety features in vehicles. With stringent regulations and consumer expectations for enhanced safety, manufacturers are increasingly incorporating advanced position sensors into their designs. These sensors are essential for systems such as electronic stability control, adaptive cruise control, and collision avoidance systems. Recent statistics indicate that the European automotive safety market is expected to reach €30 billion by 2026, reflecting a growing investment in safety technologies. This trend suggests that the automotive position-sensors market will benefit from the integration of innovative safety features, as automakers strive to meet regulatory requirements and consumer demands for safer driving experiences. Consequently, the automotive position-sensors market is likely to expand as manufacturers prioritize safety in their vehicle designs.

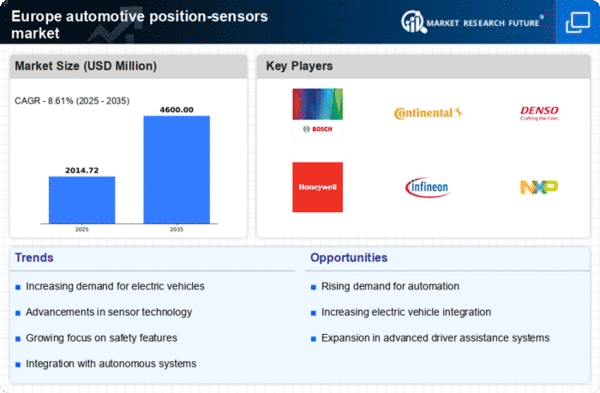

Rising Demand for Electric Vehicles

The automotive position-sensors market in Europe is experiencing a notable surge in demand due to the increasing adoption of electric vehicles (EVs). As manufacturers pivot towards EV production, the need for precise position sensing technology becomes paramount. Position sensors play a critical role in various applications, including battery management systems and electric motor control. According to recent data, the EV market in Europe is projected to grow at a CAGR of over 25% through 2025, driving the demand for advanced position-sensing solutions. This trend indicates a shift in consumer preferences towards sustainable transportation, which in turn propels the automotive position-sensors market forward. As automakers invest heavily in EV technology, the integration of sophisticated position sensors is likely to enhance vehicle performance and efficiency, thereby solidifying their importance in the automotive sector.

Growing Investment in Research and Development

The automotive position-sensors market in Europe is benefiting from a growing investment in research and development (R&D) by automotive manufacturers and technology companies. This investment is aimed at enhancing the capabilities and performance of position sensors, leading to innovations that meet the evolving demands of the automotive industry. With a focus on improving sensor accuracy, reducing costs, and integrating new technologies, R&D efforts are expected to drive advancements in the automotive position-sensors market. Recent data indicates that R&D spending in the European automotive sector is projected to exceed €20 billion annually by 2026, reflecting a commitment to innovation. This trend suggests that as manufacturers prioritize R&D, the automotive position-sensors market will likely see the introduction of cutting-edge solutions that enhance vehicle performance and safety.

Integration of Advanced Driver Assistance Systems (ADAS)

The automotive position-sensors market in Europe is poised for growth due to the increasing integration of Advanced Driver Assistance Systems (ADAS) in vehicles. ADAS technologies rely heavily on accurate position sensing to enhance vehicle control and safety. Features such as lane-keeping assistance, parking assistance, and automated driving require precise data from position sensors to function effectively. The European ADAS market is projected to grow at a CAGR of approximately 20% from 2023 to 2028, indicating a robust demand for position-sensing technologies. This trend highlights the automotive position-sensors market's potential to expand as automakers invest in ADAS to improve vehicle safety and performance. As the automotive industry continues to innovate, the reliance on advanced position sensors will likely increase, further driving market growth.