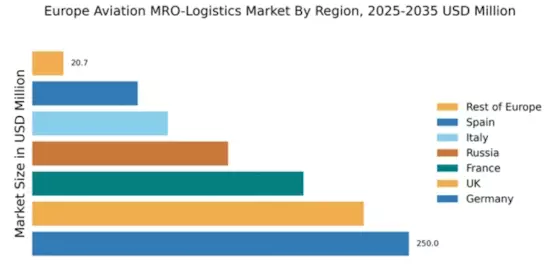

Germany : Strong Infrastructure and Innovation Drive Growth

Germany holds a dominant position in the European aviation MRO-logistics market, with a market value of $250.0 million, accounting for approximately 30% of the total market share. Key growth drivers include a robust aerospace manufacturing sector, increasing air traffic, and government initiatives promoting technological advancements. Regulatory policies favoring sustainability and safety standards further enhance demand, while significant investments in infrastructure bolster industrial development.

UK : Strong Demand from Diverse Aviation Sectors

The UK aviation MRO-logistics market is valued at $220.0 million, representing around 27% of the European market. Growth is fueled by a diverse aviation sector, including commercial, military, and business aviation. The UK government supports the industry through favorable policies and funding for research and development. Demand trends indicate a shift towards digital solutions and sustainable practices, reflecting changing consumer preferences and regulatory pressures.

France : Home to Major Aerospace Players

France's aviation MRO-logistics market is valued at $180.0 million, capturing about 22% of the European market. The sector benefits from strong demand driven by the presence of major players like Airbus and Safran, alongside government support for innovation. Regulatory frameworks emphasize safety and environmental standards, pushing companies towards sustainable practices. The market is also witnessing a rise in demand for advanced technologies and digital solutions.

Russia : Strategic Location and Resource Availability

Russia's aviation MRO-logistics market is valued at $130.0 million, accounting for approximately 16% of the European market. Key growth drivers include a strategic geographical position and increasing domestic air travel. Government initiatives aimed at modernizing the aviation sector and enhancing safety standards are also pivotal. The market is characterized by a mix of local and international players, with a focus on military and commercial aviation applications.

Italy : Focus on Sustainability and Efficiency

Italy's aviation MRO-logistics market is valued at $90.0 million, representing about 11% of the European market. Growth is driven by a focus on sustainability and efficiency, with government policies promoting green technologies. Demand trends indicate a shift towards more efficient maintenance practices and digital solutions. Key cities like Rome and Milan are central to the market, hosting major players and fostering a competitive landscape.

Spain : Investment in Infrastructure and Technology

Spain's aviation MRO-logistics market is valued at $70.0 million, capturing around 9% of the European market. The sector is experiencing growth due to increased air travel and investments in infrastructure. Government initiatives aimed at enhancing the aviation sector's competitiveness are also significant. Key cities like Madrid and Barcelona are vital hubs, with a mix of local and international players driving innovation and efficiency in operations.

Rest of Europe : Varied Growth Across Smaller Nations

The Rest of Europe aviation MRO-logistics market is valued at $20.67 million, representing a smaller share of the overall market. Growth is uneven, with some countries investing heavily in aviation infrastructure while others face economic challenges. Regulatory policies vary significantly, impacting market dynamics. Local players often dominate, focusing on niche markets and specialized services, reflecting the diverse needs of the region's aviation sector.