Shift Towards Synthetic Base Oils

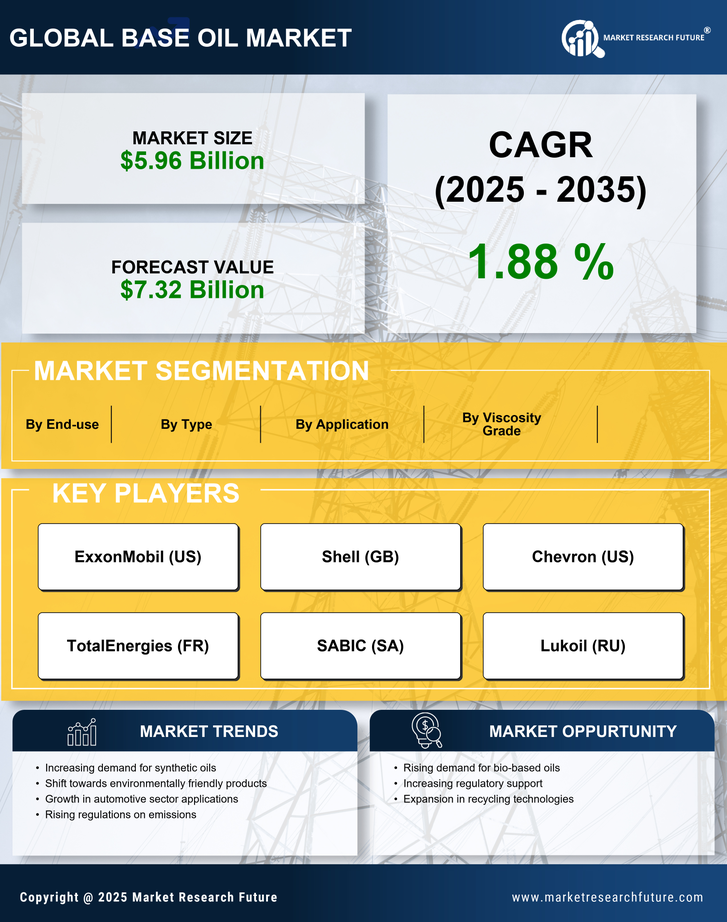

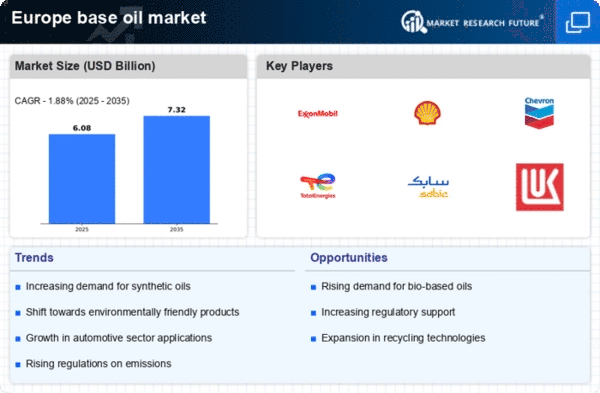

The base oil market in Europe is witnessing a significant shift towards synthetic base oils, driven by their superior properties compared to conventional mineral oils. Synthetic oils offer enhanced thermal stability, lower volatility, and improved lubrication performance, making them increasingly popular among manufacturers. As industries prioritize efficiency and sustainability, the demand for synthetic base oils is projected to grow by 6% annually through 2025. This transition is indicative of a broader trend within the base oil market, where innovation and performance are becoming critical factors in product selection.

Increased Focus on Environmental Regulations

The base oil market in Europe is significantly influenced by the tightening of environmental regulations aimed at reducing emissions and promoting sustainability. Regulatory bodies are implementing stricter guidelines for lubricant formulations, which in turn drives the demand for eco-friendly base oils. As a result, manufacturers are compelled to innovate and develop products that comply with these regulations. The market for biodegradable and environmentally friendly base oils is expected to expand by 5% in the coming years, reflecting the industry's response to regulatory pressures. This focus on compliance not only shapes product development but also influences market dynamics within the base oil market.

Rising Demand for High-Performance Lubricants

The base oil market in Europe is experiencing a notable increase in demand for high-performance lubricants. This trend is driven by the automotive and industrial sectors, which require superior lubrication solutions to enhance efficiency and reduce wear. As manufacturers strive to meet stringent performance standards, the demand for high-quality base oils is expected to rise. In 2025, the market for high-performance lubricants is projected to grow by approximately 4.5%, indicating a robust shift towards premium products. This shift not only reflects changing consumer preferences but also highlights the evolving landscape of the base oil market, where quality and performance are paramount.

Growing Automotive Sector and Electric Vehicles

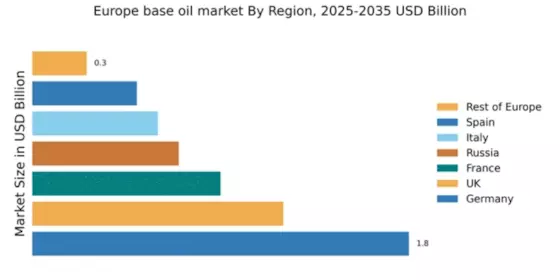

The base oil market in Europe is closely linked to the growth of the automotive sector, particularly with the rise of electric vehicles (EVs). As the automotive industry evolves, there is an increasing need for specialized lubricants that cater to the unique requirements of EVs. This shift is expected to drive demand for high-quality base oils that can enhance the performance and longevity of electric drivetrains. The automotive sector is projected to grow by 3% annually, which will likely have a positive impact on the base oil market. This trend indicates a transformative phase for the industry, as it adapts to the changing landscape of vehicle technology.

Technological Innovations in Refining Processes

The base oil market in Europe is benefiting from advancements in refining technologies that enhance the quality and efficiency of base oil production. Innovations such as hydrocracking and solvent extraction are enabling manufacturers to produce higher-quality base oils with improved properties. These technological advancements are likely to reduce production costs and increase output, thereby supporting market growth. In 2025, the adoption of these technologies is expected to contribute to a 3% increase in overall production capacity within the base oil market. This evolution underscores the importance of technology in shaping the competitive landscape of the industry.