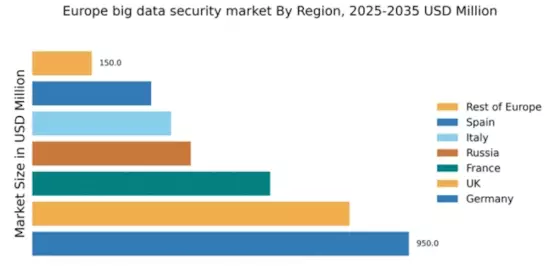

Germany : Robust Infrastructure and Innovation

Germany holds a dominant position in the European big data-security market, with a market value of $950.0 million, representing approximately 30% of the total market share. Key growth drivers include stringent data protection regulations like the GDPR, which have heightened demand for security solutions. The increasing adoption of cloud services and IoT devices further fuels consumption patterns, while government initiatives promote cybersecurity investments and infrastructure development.

UK : Strong Demand and Innovation

The UK market for big data security is valued at $800.0 million, accounting for about 25% of the European market. Growth is driven by rising cyber threats and the need for compliance with regulations such as the Data Protection Act. The demand for advanced analytics and AI-driven security solutions is on the rise, reflecting a shift towards proactive security measures. The UK government also supports cybersecurity initiatives, enhancing the overall market landscape.

France : Regulatory Support and Investment

France's big data-security market is valued at $600.0 million, representing 19% of the European market. Key growth drivers include the French Digital Security Strategy, which emphasizes investment in cybersecurity. The increasing reliance on digital services and e-commerce has led to heightened demand for robust security solutions. Additionally, local initiatives encourage collaboration between public and private sectors to enhance cybersecurity infrastructure.

Russia : Regulatory Landscape and Demand

Russia's big data-security market is valued at $400.0 million, making up 13% of the European market. Growth is driven by increasing cyber threats and the need for compliance with local regulations like the Federal Law on Personal Data. Demand for security solutions is rising, particularly in sectors such as finance and telecommunications. However, geopolitical factors and regulatory challenges can impact market dynamics and foreign investments.

Italy : Investment and Compliance Focus

Italy's big data-security market is valued at $350.0 million, accounting for 11% of the European market. Growth is supported by the Italian Data Protection Authority's initiatives to enhance cybersecurity measures. The increasing digitalization of businesses drives demand for security solutions, particularly in the banking and healthcare sectors. Local investments in cybersecurity infrastructure are also on the rise, fostering a more secure digital environment.

Spain : Regulatory Initiatives and Growth

Spain's big data-security market is valued at $300.0 million, representing 9% of the European market. Key growth drivers include the Spanish Cybersecurity Strategy, which aims to bolster national security. The demand for data protection solutions is increasing, particularly in sectors like retail and finance. Local companies are also investing in advanced security technologies, reflecting a proactive approach to cybersecurity challenges.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe accounts for a market value of $150.0 million, representing 5% of the total European market. Growth varies significantly across countries, driven by local regulations and market maturity. Emerging markets are increasingly adopting data security solutions, influenced by EU-wide regulations. The competitive landscape includes both local and international players, catering to diverse industry needs and compliance requirements.