Market Share

Europe Biochar Market Share Analysis

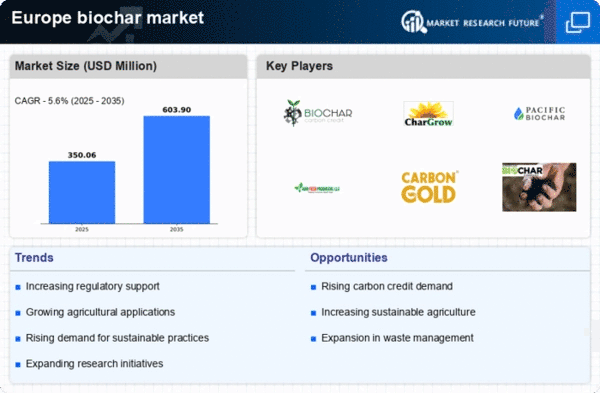

Market competition along with presence of major players also influence Europe’s BioChar Market dynamics distinctly. Established enterprises within the field have undertaken strategic initiatives like consolidations, mergers-cum-acquisitions besides partnerships aimed at enhancing their competitive position and enlarging product lines. This kind of competition enhances innovation and leads to overall growth and expansion of the European biochar market.

Global economic factors like trade relationships as well as geopolitical developments also have an impact on Europe’s BioChar Market. Economic conditions change costs of production, trading dynamics and access into markets. Fluctuations in prices that result from factors such as changes in costs of raw materials, disruptions in global supply chains cause instability in the overall market.

Another considerable market share positioning strategy includes strategic alliances and collaborations. Firms seek partnerships with research institutes, farming entities, and public organizations to gain a competitive advantage in the market. These partnerships provide not only access to invaluable resources and skills but also enhance the reputation of involved companies. By associating themselves with well-known organizations, businesses can cultivate trust amongst their customers and get ahead in the Europe Biochar Market.

Besides, sustainable practices have become an essential pillar of market positioning. Companies have embraced eco-friendly production processes, sourcing methods as well as packaging solutions following increased consumer environmental consciousness. Being holistic in terms of sustainability firms do not just appeal to green consumers but also meet changing legal requirements thus securing their place on the market indefinitely.

Consequently, penetration strategies are important for shaping the market share landscape. Companies use different channels of distribution including traditional and online platforms to increase their coverage and availability of biochar products to more people. This approach is characterized by aggressive promotional activities, price competition strategies, as well as efficient supply chain management. Effective penetration strategies help companies take a larger portion of the market especially in areas where biochar for agriculture is still developing.

Additionally, customer education and awareness programs are instrumental in market share positioning. Enterprises invest into educating farmers about biochar benefits for agriculture development programs targeting policy makers or other concerned parties responsible for public health systems worldwide can be introduced by firms which produce or promote BCs as such campaigns could help creating right attitude towards BC that will lead to its wide application in different sectors hence attract many customers hence gaining much profit.

Leave a Comment