Increasing Cybersecurity Threats

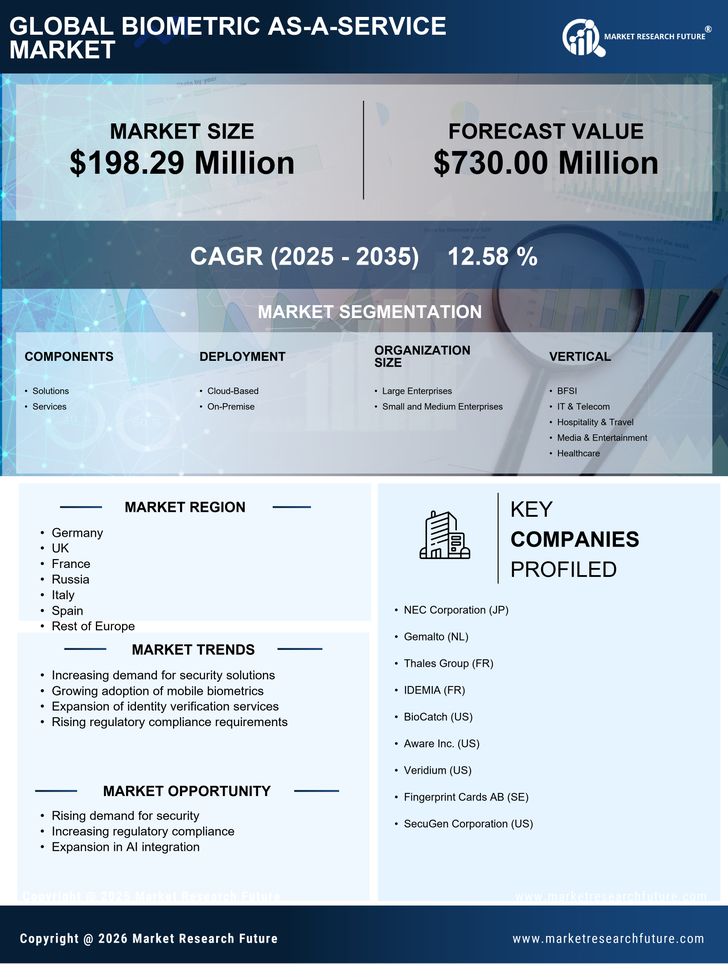

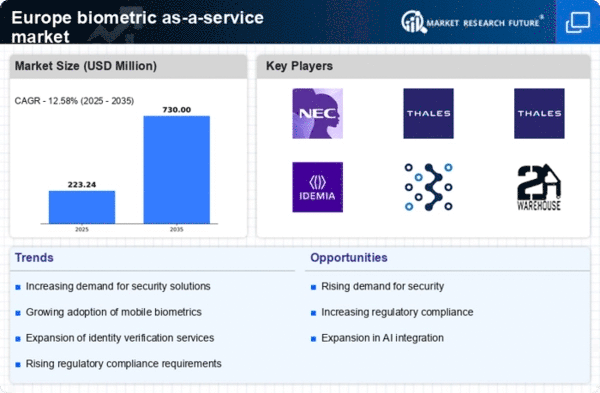

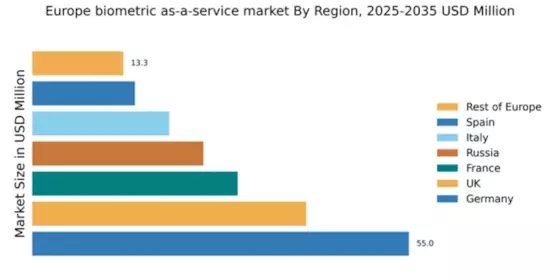

The biometric as-a-service market is experiencing growth due to the rising incidence of cybersecurity threats. As organizations face sophisticated attacks, the need for robust security measures becomes paramount. Biometric solutions, which offer unique identification methods, are increasingly adopted to mitigate risks. In 2025, it is estimated that the cybersecurity market in Europe will reach €100 billion, with biometric technologies playing a crucial role in enhancing security protocols. This trend indicates a shift towards more secure authentication methods, as traditional passwords become less effective against cyber threats. Consequently, the biometric as-a-service market is likely to expand as businesses seek to protect sensitive data and maintain customer trust.

Consumer Awareness and Acceptance

The biometric as-a-service market is significantly influenced by increasing consumer awareness and acceptance of biometric technologies. As individuals become more familiar with biometric authentication methods, their willingness to adopt these solutions grows. Surveys indicate that over 70% of consumers in Europe are open to using biometric identification for secure transactions. This shift in consumer sentiment is likely to drive demand for biometric as-a-service solutions, as businesses recognize the importance of aligning with customer preferences. In 2025, the market is expected to see a surge in adoption rates, as organizations strive to enhance user experience and build trust through secure authentication methods. This trend suggests a promising future for the biometric as-a-service market.

Regulatory Compliance and Standards

The biometric as-a-service market is driven by the need for regulatory compliance and adherence to industry standards. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt secure identification methods. Biometric solutions offer a viable means to ensure compliance while enhancing security. In 2025, it is anticipated that the market for compliance-related technologies will grow by 15%, with biometrics playing a pivotal role. This regulatory landscape encourages businesses to invest in biometric as-a-service solutions, as they seek to avoid penalties and protect consumer data. Consequently, the market is likely to witness increased adoption as organizations strive to meet compliance requirements.

Growing Adoption of Digital Services

The biometric as-a-service market is significantly influenced by the growing adoption of digital services across various sectors. As businesses transition to digital platforms, the demand for secure and efficient authentication methods rises. In 2025, it is projected that the digital services market in Europe will surpass €200 billion, with a substantial portion allocated to security solutions. Biometric technologies, such as facial recognition and fingerprint scanning, are increasingly integrated into mobile applications and online services. This integration not only enhances user experience but also ensures compliance with stringent security regulations. The biometric as-a-service market is thus positioned to benefit from this digital transformation, as organizations prioritize secure access to their services.

Technological Advancements in Biometric Solutions

The biometric as-a-service market is propelled by rapid technological advancements in biometric solutions. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems. In 2025, the market for AI-driven biometric technologies is expected to grow by 20%, reflecting the increasing reliance on advanced analytics for identity verification. These advancements enable organizations to implement more sophisticated biometric solutions, such as voice recognition and behavioral biometrics, which offer higher security levels. As businesses seek to leverage these technologies, the biometric as-a-service market is likely to expand, providing organizations with cutting-edge solutions to address their security needs.