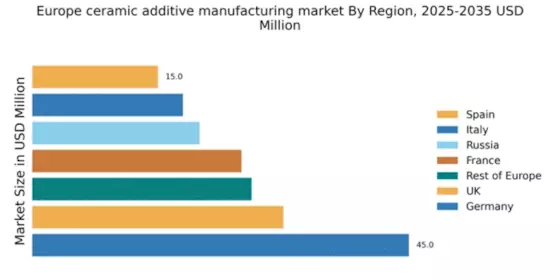

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 45.0% market share in the ceramic additive manufacturing sector, valued at approximately €1.5 billion. Key growth drivers include robust industrial infrastructure, a strong focus on R&D, and government initiatives promoting advanced manufacturing technologies. Demand is rising in sectors like aerospace and automotive, supported by favorable regulatory policies that encourage innovation and sustainability in manufacturing processes. The country’s commitment to Industry 4.0 further enhances its competitive edge.

UK : Innovation and Investment Drive Growth

The UK commands a 30.0% share of the ceramic additive manufacturing market, valued at around €900 million. Growth is driven by increasing investments in technology and a burgeoning startup ecosystem focused on 3D printing. Demand is particularly strong in healthcare and aerospace, with government initiatives supporting research and development. The UK’s regulatory framework encourages sustainable practices, making it an attractive market for innovative solutions in manufacturing.

France : Diverse Applications and Strong Demand

France holds a 25.0% market share in the ceramic additive manufacturing sector, valued at approximately €750 million. The growth is fueled by diverse applications in sectors such as automotive, aerospace, and art. Government support for innovation and sustainability initiatives has bolstered demand. The regulatory environment is favorable, promoting the adoption of advanced manufacturing technologies, which is crucial for maintaining competitiveness in the European market.

Russia : Strategic Investments in Technology

With a 20.0% market share, Russia's ceramic additive manufacturing market is valued at about €600 million. Key growth drivers include strategic investments in technology and a focus on local production capabilities. Demand is increasing in sectors like defense and construction, supported by government initiatives aimed at enhancing domestic manufacturing. The regulatory landscape is evolving, encouraging innovation and investment in advanced manufacturing technologies.

Italy : Heritage and Innovation Combined

Italy captures an 18.0% share of the ceramic additive manufacturing market, valued at approximately €540 million. The growth is driven by a blend of traditional craftsmanship and modern technology, particularly in the ceramics and design sectors. Government initiatives promoting innovation and sustainability are enhancing market dynamics. The competitive landscape features a mix of established players and innovative startups, particularly in regions like Lombardy and Emilia-Romagna.

Spain : Growth Through Innovation and Demand

Spain holds a 15.0% market share in the ceramic additive manufacturing sector, valued at around €450 million. The market is driven by increasing demand in sectors such as construction and healthcare, supported by government initiatives promoting technological advancement. The competitive landscape is characterized by a growing number of local players and collaborations with international firms, particularly in regions like Catalonia and Madrid, enhancing the overall business environment.

Rest of Europe : Varied Applications Across Regions

The Rest of Europe accounts for a 26.21% share of the ceramic additive manufacturing market, valued at approximately €800 million. Growth is driven by diverse applications across various sectors, including healthcare, automotive, and consumer goods. Regulatory policies across different countries are increasingly supportive of additive manufacturing, fostering innovation. The competitive landscape features a mix of local and international players, with significant activity in countries like Belgium and the Netherlands.