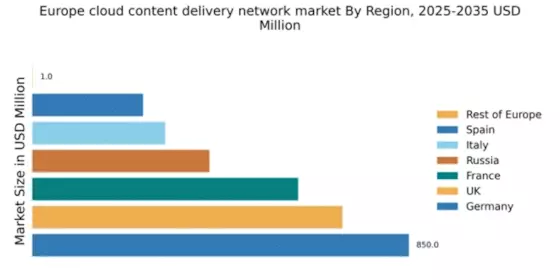

Germany : Strong Infrastructure and Demand Growth

Germany holds a dominant position in the European cloud content-delivery-network market, with a market value of $850.0 million, representing approximately 30% of the total market share. Key growth drivers include the increasing demand for high-speed internet, robust data protection regulations, and significant investments in digital infrastructure. The German government has initiated various programs to enhance digitalization across industries, further fueling market growth. Additionally, the rise in e-commerce and streaming services has led to a surge in content delivery needs.

UK : Innovation and Investment Drive Growth

The UK cloud content-delivery-network market is valued at $700.0 million, accounting for about 25% of the European market. The growth is driven by a strong focus on innovation, with many tech startups emerging in cities like London and Manchester. The UK government supports digital transformation through various initiatives, including the Digital Strategy 2025. The demand for cloud services is also bolstered by the increasing adoption of remote work and online services, leading to a shift in consumption patterns.

France : Government Support and Market Demand

France's cloud content-delivery-network market is valued at $600.0 million, representing around 22% of the European market. The growth is fueled by government initiatives aimed at enhancing digital infrastructure and promoting cloud adoption across sectors. Cities like Paris and Lyon are key markets, with a rising number of enterprises migrating to cloud solutions. The competitive landscape features major players like AWS and Microsoft Azure, which are capitalizing on the increasing demand for digital services and e-commerce.

Russia : Regulatory Changes and Growth Opportunities

Russia's cloud content-delivery-network market is valued at $400.0 million, making up about 15% of the European market. The growth is driven by regulatory changes that encourage local data storage and cloud adoption. Key cities like Moscow and St. Petersburg are witnessing increased demand for cloud services, particularly in the tech and finance sectors. The competitive landscape includes both local and international players, with a focus on compliance with Russian data laws, creating unique market dynamics.

Italy : Digital Transformation in Key Industries

Italy's cloud content-delivery-network market is valued at $300.0 million, representing approximately 11% of the European market. The growth is driven by the digital transformation of traditional industries, particularly in manufacturing and retail. Government initiatives, such as the National Plan for Digital Transformation, are fostering cloud adoption. Key markets include Milan and Rome, where major players like Google Cloud and Fastly are establishing a strong presence to meet the rising demand for digital services.

Spain : Investment in Digital Infrastructure

Spain's cloud content-delivery-network market is valued at $250.0 million, accounting for about 9% of the European market. The growth is supported by significant investments in digital infrastructure and a growing demand for online services. Cities like Barcelona and Madrid are central to this expansion, with a focus on sectors such as tourism and e-commerce. The competitive landscape features both local and international players, with a strong emphasis on enhancing user experience and service delivery.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe holds a minimal market value of $1.0 million, indicating niche opportunities in the cloud content-delivery-network sector. Various smaller countries are beginning to adopt cloud solutions, driven by local demand for digital services. The competitive landscape is fragmented, with smaller players emerging to cater to specific regional needs. Government initiatives across these countries are gradually promoting digital transformation, albeit at a slower pace compared to larger markets.