Germany : Strong industrial base drives growth

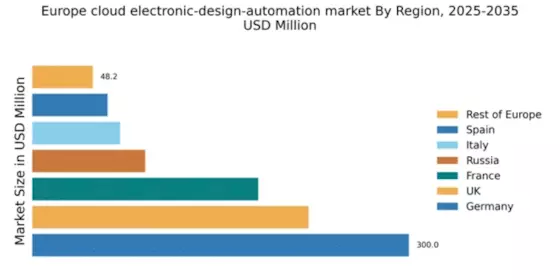

Germany holds a dominant position in the European cloud electronic-design-automation (EDA) market, valued at $300.0 million, representing a significant market share. Key growth drivers include a robust automotive sector, increasing demand for semiconductor design, and government initiatives promoting digital transformation. Regulatory policies favoring innovation and investment in R&D further enhance market dynamics, while advanced infrastructure supports industrial development.

UK : Innovation fuels competitive landscape

The UK EDA market is valued at $220.0 million, showcasing a strong growth trajectory driven by advancements in telecommunications and aerospace sectors. Demand for cloud-based solutions is rising, supported by government initiatives aimed at fostering tech startups and innovation. Regulatory frameworks are increasingly accommodating, promoting a favorable business environment for EDA providers and users alike.

France : Diverse industries drive demand

France's cloud EDA market is valued at $180.0 million, with growth fueled by the aerospace, automotive, and telecommunications sectors. The French government actively supports digital transformation through funding and regulatory incentives, enhancing the adoption of EDA solutions. Demand trends indicate a shift towards integrated design processes, reflecting the need for efficiency and innovation in product development.

Russia : Government initiatives boost growth

Russia's cloud EDA market is valued at $90.0 million, with growth driven by government initiatives aimed at modernizing the electronics sector. Demand for EDA solutions is increasing, particularly in defense and telecommunications industries. Regulatory support for local technology development and investment in infrastructure are key factors contributing to market expansion, despite existing challenges in the business environment.

Italy : Manufacturing sector leads demand

Italy's cloud EDA market is valued at $70.0 million, with significant growth driven by the manufacturing and automotive sectors. The Italian government promotes digitalization through various initiatives, enhancing the adoption of EDA technologies. Demand trends indicate a rising interest in cloud-based solutions, reflecting a shift towards more agile design processes in local industries.

Spain : Tech innovation drives growth

Spain's cloud EDA market is valued at $60.0 million, with growth fueled by advancements in the renewable energy and telecommunications sectors. Government initiatives aimed at fostering innovation and digital transformation are pivotal in driving demand for EDA solutions. The competitive landscape is evolving, with local startups emerging alongside established players, enhancing market dynamics.

Rest of Europe : Varied markets, unique challenges

The Rest of Europe EDA market is valued at $48.21 million, characterized by diverse growth opportunities across various countries. Demand is driven by local industries such as automotive, telecommunications, and consumer electronics. Regulatory environments vary, influencing market dynamics and competitive landscapes. Local players are increasingly collaborating with The cloud electronic-design-automation market reach.