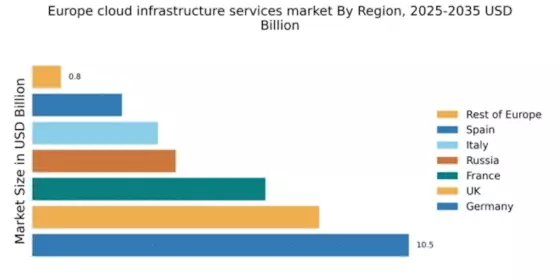

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 10.5% market share in the European cloud infrastructure-services sector, valued at approximately €12 billion. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and supportive government policies promoting cloud adoption. The demand for cloud services is driven by sectors like automotive, manufacturing, and finance, with a focus on data security and compliance with GDPR regulations. Infrastructure investments, particularly in data centers, are also on the rise, enhancing service delivery capabilities.

UK : Innovation and Investment at Forefront

The UK commands an 8.0% share of the European cloud market, translating to around €9 billion. Growth is fueled by a vibrant tech startup scene, significant investments in AI and machine learning, and a strong push towards digital transformation across industries. The UK government has initiated various programs to enhance cloud adoption, particularly in public services and healthcare, driving demand for scalable solutions. The market is characterized by a shift towards hybrid cloud models, reflecting changing consumption patterns.

France : Strong Demand Across Sectors

France holds a 6.5% market share in the cloud infrastructure-services market, valued at approximately €7.5 billion. Key growth drivers include a focus on digital sovereignty, with government initiatives promoting local data centers and cloud services. The demand is particularly strong in sectors like retail, finance, and public administration, where cloud solutions are increasingly adopted for operational efficiency. Regulatory frameworks are evolving to support innovation while ensuring data protection and compliance with EU regulations.

Russia : Strategic Investments and Development

Russia's cloud infrastructure-services market accounts for 4.0% of the European share, valued at around €4.5 billion. Growth is driven by increasing digitalization across various sectors, including telecommunications and finance, alongside government initiatives aimed at enhancing IT infrastructure. The demand for cloud services is rising, particularly in urban centers like Moscow and St. Petersburg, where businesses are adopting cloud solutions for scalability and cost efficiency. Local players are emerging, but competition with global giants remains intense.

Italy : Focus on Digital Transformation

Italy captures a 3.5% share of the European cloud market, valued at approximately €4 billion. The growth is propelled by a national push for digital transformation, particularly in small and medium-sized enterprises (SMEs). Government initiatives, such as the 'Piano Nazionale di Ripresa e Resilienza', aim to enhance cloud adoption across various sectors. Demand is particularly strong in manufacturing and retail, where businesses are increasingly leveraging cloud solutions for operational efficiency and innovation.

Spain : Investment and Growth Opportunities

Spain holds a 2.5% share of the European cloud infrastructure market, valued at around €3 billion. The growth is driven by increasing investments in digital infrastructure and a rising number of startups leveraging cloud technologies. Government initiatives aimed at promoting digitalization across sectors, particularly in tourism and finance, are enhancing demand for cloud services. The competitive landscape features both local and international players, with a focus on providing tailored solutions to meet specific industry needs.

Rest of Europe : Fragmented Market with Potential

The Rest of Europe accounts for a modest 0.8% of the cloud infrastructure market, valued at approximately €1 billion. This sub-region includes various smaller markets with unique growth opportunities driven by local demand for cloud services. Factors such as increasing digitalization, government support for tech innovation, and the rise of SMEs are contributing to market growth. However, the competitive landscape is fragmented, with numerous local players vying for market share, making it a challenging yet promising environment for cloud services.