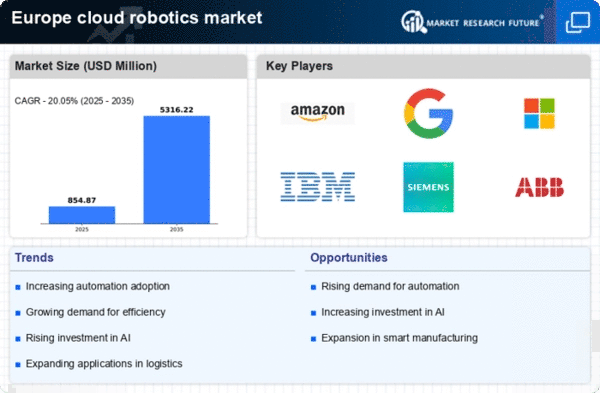

Rising Demand for Automation

The cloud robotics market in Europe experiences a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and healthcare are increasingly adopting robotic solutions to enhance operational efficiency and reduce labor costs. According to recent estimates, the automation market in Europe is projected to grow at a CAGR of approximately 15% from 2025 to 2030. This trend indicates a strong inclination towards integrating cloud robotics into existing systems, allowing for real-time data processing and improved decision-making. As businesses strive to remain competitive, the cloud robotics market is likely to benefit from this growing demand, leading to innovative solutions that cater to specific industry needs.

Growing Focus on Sustainability

Sustainability has become a critical focus for industries across Europe, influencing the cloud robotics market. Companies are seeking ways to reduce their carbon footprint and improve resource efficiency. Cloud robotics can play a pivotal role in achieving these sustainability goals by optimizing processes and minimizing waste. For example, robotic systems can enhance supply chain efficiency, leading to reduced energy consumption and lower emissions. As organizations increasingly prioritize sustainable practices, the cloud robotics market is expected to see a rise in demand for eco-friendly robotic solutions that align with these objectives.

Government Initiatives and Funding

European governments are increasingly recognizing the potential of cloud robotics to drive economic growth and innovation. Various initiatives and funding programs are being launched to support research and development in this field. For instance, the European Commission has allocated substantial resources to promote robotics and AI technologies, with funding exceeding €1 billion for projects aimed at enhancing industrial competitiveness. Such government support is likely to stimulate the cloud robotics market, encouraging collaboration between public and private sectors and fostering an environment conducive to technological advancements.

Advancements in AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into cloud robotics is transforming the landscape of the cloud robotics market in Europe. These advancements enable robots to learn from their environments, adapt to new tasks, and improve their performance over time. The European AI market is expected to reach €100 billion by 2025, which suggests a significant investment in technologies that enhance robotic capabilities. As AI continues to evolve, the cloud robotics market is poised to leverage these innovations, resulting in smarter, more efficient robotic systems that can operate autonomously in complex environments.

Increased Connectivity and IoT Integration

The proliferation of the Internet of Things (IoT) is significantly impacting the cloud robotics market in Europe. Enhanced connectivity allows robots to communicate seamlessly with other devices and systems, facilitating data exchange and collaborative operations. This interconnectedness is crucial for the development of smart factories and automated supply chains. The IoT market in Europe is projected to grow to €200 billion by 2025, indicating a robust environment for cloud robotics to thrive. As IoT integration becomes more prevalent, the cloud robotics market is likely to benefit from improved operational efficiencies and innovative applications.