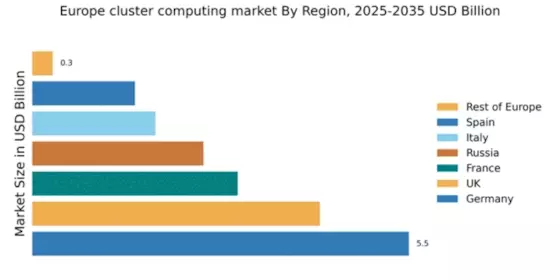

Germany : Innovation Drives Market Dominance

Key markets include cities like Munich, Berlin, and Frankfurt, which are home to numerous tech companies and research institutions. The competitive landscape features major players such as Hewlett Packard Enterprise, IBM, and Dell Technologies, all vying for market share. The local business environment is characterized by a strong emphasis on innovation and collaboration between academia and industry, particularly in sectors like automotive and manufacturing.

UK : Tech Adoption Fuels Market Expansion

Key markets include London, Manchester, and Cambridge, which are tech hubs with a vibrant startup ecosystem. The competitive landscape features significant players like Microsoft and Amazon Web Services, alongside local firms. The business environment is dynamic, with a focus on fintech and health tech, driving demand for advanced computing solutions.

France : Diverse Applications Drive Demand

Key markets include Paris, Toulouse, and Lyon, which are centers for aerospace and technology. The competitive landscape features major players like IBM and Oracle, alongside local startups. The business environment is characterized by a collaborative approach between industry and research institutions, particularly in sectors focused on green technology and smart cities.

Russia : Market Potential in Tech Sector

Key markets include Moscow and St. Petersburg, which are hubs for technology and innovation. The competitive landscape features local players alongside international firms like Cisco and IBM. The business environment is complex, with a focus on state-driven initiatives and a growing emphasis on cybersecurity and data protection.

Italy : Innovation and Investment Surge

Key markets include Milan, Turin, and Rome, which are centers for manufacturing and technology. The competitive landscape features major players like Dell Technologies and Lenovo, alongside a growing number of local startups. The business environment is evolving, with a focus on digital transformation in traditional industries and a rise in tech-driven entrepreneurship.

Spain : Digital Transformation Accelerates Growth

Key markets include Madrid and Barcelona, which are vibrant tech hubs. The competitive landscape features significant players like Amazon Web Services and Microsoft, alongside local firms. The business environment is characterized by a strong focus on digital innovation, particularly in sectors like e-commerce and fintech.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include smaller nations like Belgium and the Netherlands, which have emerging tech sectors. The competitive landscape is fragmented, with local players dominating. The business environment is diverse, with varying levels of government support and industry focus, particularly in sectors like logistics and healthcare.