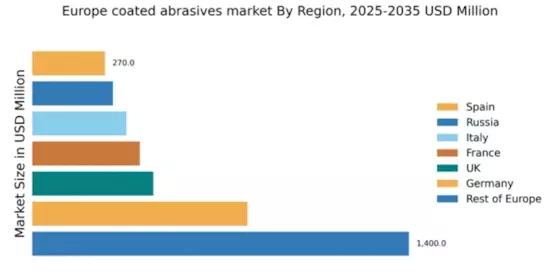

Germany : Strong industrial base drives growth

Key markets include industrial hubs like Stuttgart, Munich, and Hamburg, where major players such as Klingspor and Dronco have a strong presence. The competitive landscape is characterized by innovation and quality, with local manufacturers adapting to specific industry needs. The business environment is favorable, supported by government initiatives aimed at enhancing manufacturing efficiency. Applications span automotive, aerospace, and construction sectors, driving diverse demand for coated abrasives.

UK : Diverse industries boost demand

Key markets include London, Birmingham, and Manchester, where major players like Norton Abrasives and 3M operate. The competitive landscape is marked by a mix of local and international companies, fostering innovation. The business environment is dynamic, with a focus on quality and performance. Applications in construction, automotive, and woodworking industries are significant, driving the demand for coated abrasives.

France : Strong demand from manufacturing sector

Key markets include Paris, Lyon, and Toulouse, where major players like Saint-Gobain and Mirka have established a strong foothold. The competitive landscape features a blend of domestic and international companies, fostering innovation and quality. The business environment is supportive, with government incentives for technological advancements. Applications in aerospace, automotive, and metalworking sectors are driving significant demand for coated abrasives.

Russia : Emerging industries drive demand

Key markets include Moscow, St. Petersburg, and Kazan, where local and international players compete. The competitive landscape is characterized by a mix of established brands and emerging local manufacturers. The business environment is improving, with government support for industrial development. Applications in construction, automotive, and metalworking industries are significant, driving the demand for coated abrasives.

Italy : Strong craftsmanship fuels growth

Key markets include Milan, Turin, and Bologna, where major players like Klingspor and Norton Abrasives have a significant presence. The competitive landscape is vibrant, with a mix of local artisans and large manufacturers. The business environment is favorable, with government incentives for innovation and quality improvement. Applications in furniture, automotive, and metalworking sectors are driving substantial demand for coated abrasives.

Spain : Construction sector drives demand

Key markets include Madrid, Barcelona, and Valencia, where major players like Mirka and Sia Abrasives are active. The competitive landscape features a mix of domestic and international companies, fostering innovation and quality. The business environment is improving, with government support for technological advancements. Applications in construction, automotive, and woodworking industries are significant, driving the demand for coated abrasives.

Rest of Europe : Varied demand across regions

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, where major players like 3M and Saint-Gobain have established a presence. The competitive landscape is characterized by a mix of local and international companies, fostering innovation. The business environment varies by country, with some regions benefiting from strong government support for industrial development. Applications in automotive, construction, and metalworking sectors are driving significant demand for coated abrasives.