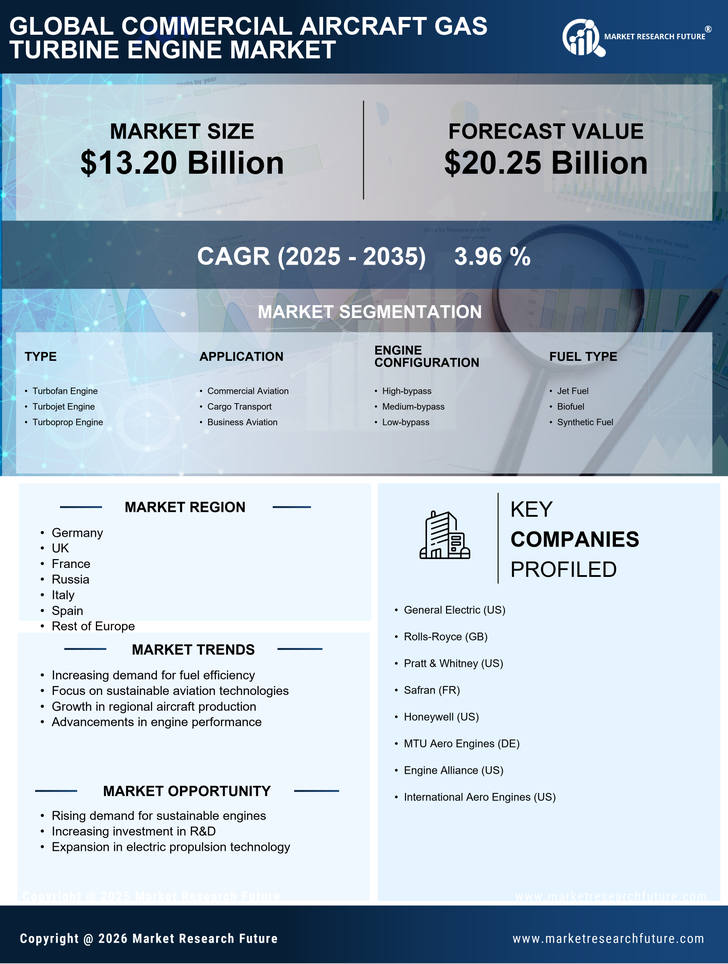

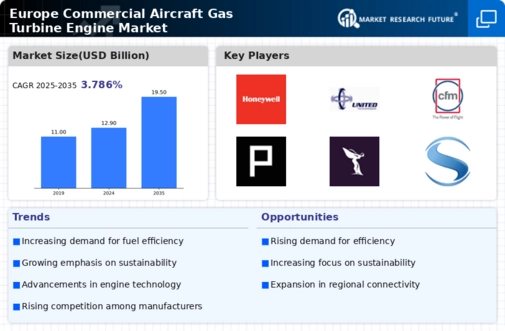

Rising Air Travel Demand

the market is experiencing a surge in demand due to the rising air travel demand.. According to the European Organisation for the Safety of Air Navigation (Eurocontrol), air traffic in Europe is expected to reach pre-pandemic levels by 2026, with a projected annual growth rate of 3.5%. This increase in passenger numbers necessitates the production of more fuel-efficient and reliable aircraft engines. Airlines are seeking to expand their fleets to accommodate this growth, which in turn drives the demand for advanced gas turbine engines. The market is likely to see a significant uptick in orders for new aircraft, with a corresponding increase in engine production, thereby bolstering the commercial aircraft-gas-turbine-engine market.

Technological Innovations in Engine Design

Technological innovations in engine design are a pivotal driver for the commercial aircraft-gas-turbine-engine market in Europe. The industry is witnessing advancements such as the development of geared turbofan engines and hybrid-electric propulsion systems. These innovations aim to enhance fuel efficiency and reduce noise levels, aligning with the growing emphasis on sustainability. For instance, the latest models are achieving fuel burn reductions of up to 15%, which is crucial for airlines looking to lower operational costs. Furthermore, the integration of digital technologies, such as predictive maintenance and real-time monitoring, is expected to improve engine performance and reliability. As these technologies mature, they are likely to reshape the competitive landscape of the commercial aircraft-gas-turbine-engine market.

Focus on Fuel Efficiency and Cost Reduction

The focus on fuel efficiency and cost reduction is a critical driver for the commercial aircraft-gas-turbine-engine market in Europe. Airlines are increasingly prioritizing operational efficiency to mitigate rising fuel costs and enhance profitability. The demand for engines that offer lower fuel consumption is paramount, as fuel expenses account for a significant portion of airline operating costs, often exceeding 30%. Consequently, manufacturers are investing in research and development to create engines that not only meet regulatory standards but also provide substantial cost savings. The trend towards lightweight materials and advanced aerodynamics is expected to yield engines with improved fuel efficiency, thereby driving growth in the commercial aircraft-gas-turbine-engine market.

Regulatory Compliance and Emission Standards

the market is increasingly influenced by stringent regulatory compliance and emission standards.. The European Union has implemented rigorous environmental regulations aimed at reducing greenhouse gas emissions from aviation. For instance, the European Commission's Fit for 55 package aims to cut emissions by at least 55% by 2030. This regulatory landscape compels manufacturers to innovate and develop engines that meet these standards, thereby driving demand for advanced gas turbine technologies. The market is projected to grow as companies invest in cleaner technologies, with an estimated increase in engine efficiency by 20% over the next decade. This shift not only aligns with environmental goals but also enhances the competitiveness of European manufacturers in the global market.

Investment in Infrastructure and Manufacturing Capabilities

Investment in infrastructure and manufacturing capabilities is a significant driver for the commercial aircraft-gas-turbine-engine market in Europe. The European aerospace sector is witnessing substantial investments aimed at enhancing production facilities and supply chain efficiencies. Governments and private entities are allocating funds to modernize manufacturing plants, which is expected to increase production capacity by 25% over the next five years. This investment not only supports the growing demand for aircraft engines but also fosters innovation in manufacturing processes, such as additive manufacturing and automation. As a result, the commercial aircraft-gas-turbine-engine market is likely to benefit from improved operational efficiencies and reduced lead times, positioning European manufacturers favorably in the competitive landscape.