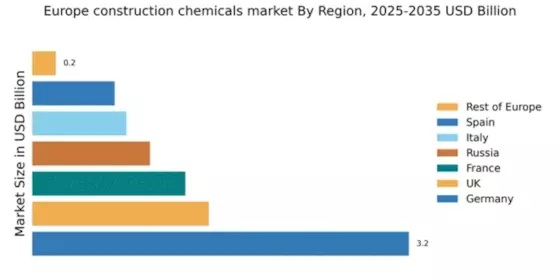

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 3.2 USD Billion in the construction chemicals sector., driven by robust infrastructure projects and a booming construction industry. Key growth drivers include government initiatives promoting sustainable building practices and significant investments in urban development. The demand for innovative solutions, such as eco-friendly materials, is on the rise, supported by stringent regulatory policies aimed at reducing environmental impact. The industrial sector's expansion further fuels consumption patterns, particularly in urban areas.

UK : Diverse Applications and Strong Players

The UK construction chemicals market, valued at 1.5, is characterized by resilience despite economic uncertainties. Key growth drivers include ongoing infrastructure projects and a shift towards sustainable construction practices. Demand trends indicate a rising preference for high-performance materials, particularly in urban regeneration projects. Government policies supporting green building initiatives further enhance market potential, while the competitive landscape remains vibrant with established players like Fosroc and GCP Applied Technologies.

France : Focus on Eco-Friendly Solutions

France's construction chemicals market, valued at 1.3, is experiencing growth driven by innovation and sustainability. The demand for eco-friendly products is increasing, supported by government regulations promoting green building practices. Key growth drivers include urbanization and infrastructure development, particularly in cities like Paris and Lyon. The competitive landscape features major players such as Arkema and Bostik, who are investing in R&D to meet evolving consumer preferences and regulatory requirements.

Russia : Infrastructure Development Fuels Demand

Russia's construction chemicals market, valued at 1.0, is emerging as a significant player in Europe. Key growth drivers include substantial government investments in infrastructure and housing projects. Demand trends reflect a growing need for advanced construction materials, particularly in major cities like Moscow and St. Petersburg. The competitive landscape is evolving, with both local and international players vying for market share, creating a dynamic business environment that encourages innovation and collaboration.

Italy : Heritage Meets Modern Innovation

Italy's construction chemicals market, valued at 0.8, is characterized by steady growth driven by a blend of heritage and modern innovation. Key growth drivers include ongoing restoration projects and new construction initiatives, particularly in cities like Milan and Rome. Demand trends indicate a preference for high-quality materials that meet both aesthetic and functional requirements. The competitive landscape features established players like Mapei, who are adapting to local market dynamics and consumer preferences.

Spain : Post-Pandemic Recovery and Growth

Spain's construction chemicals market, valued at 0.7, is revitalizing post-pandemic, driven by strong demand in residential and commercial sectors. Key growth drivers include government initiatives aimed at boosting construction and urban development. Demand trends reflect a shift towards sustainable materials, supported by regulatory frameworks promoting eco-friendly practices. The competitive landscape includes major players like Sika, who are well-positioned to capitalize on emerging opportunities in the market.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe construction chemicals market, valued at 0.2, presents a fragmented landscape with diverse opportunities. Key growth drivers include localized infrastructure projects and varying regulatory environments across countries. Demand trends are influenced by regional construction activities, with specific applications in residential and commercial sectors. The competitive landscape is characterized by a mix of local and international players, each adapting to unique market conditions and consumer needs.