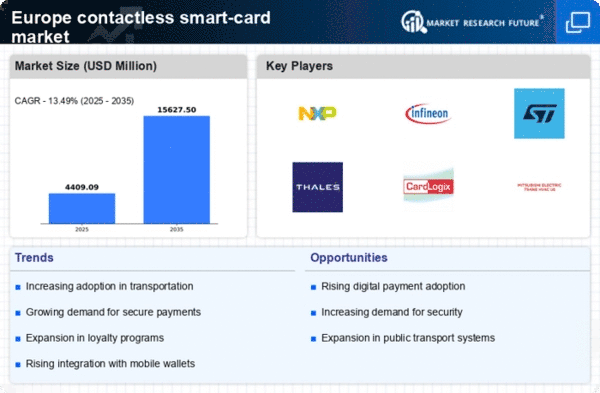

Growing Demand for Contactless Payments

The rising consumer preference for contactless payment methods is a pivotal driver in the contactless smart-card market. In Europe, the shift towards digital transactions has been pronounced, with a reported increase of 30% in contactless payment usage over the past year. This trend is largely attributed to the convenience and speed offered by contactless smart cards, which allow users to complete transactions swiftly without the need for physical contact. Retailers are increasingly adopting these technologies to enhance customer experience and streamline payment processes. As a result, the contactless smart-card market is witnessing robust growth, with projections indicating a potential market value exceeding €10 billion by 2026. This demand is further fueled by the expansion of e-commerce and mobile payment solutions, which are becoming integral to the European retail landscape.

Increased Focus on Consumer Convenience

Consumer convenience is becoming a central focus for businesses in the contactless smart-card market. As lifestyles evolve, there is a growing expectation for quick and efficient payment solutions. In Europe, the demand for seamless transaction experiences has led to a surge in the adoption of contactless smart cards, which allow users to make payments with a simple tap. This trend is particularly evident in urban areas, where busy consumers prioritize speed and efficiency. Retailers and service providers are responding by integrating contactless payment options into their systems, thereby enhancing customer satisfaction. The contactless smart-card market is likely to benefit from this shift, with forecasts indicating that convenience-driven innovations could account for a 25% increase in market growth over the next few years. This focus on consumer convenience is reshaping the payment landscape in Europe.

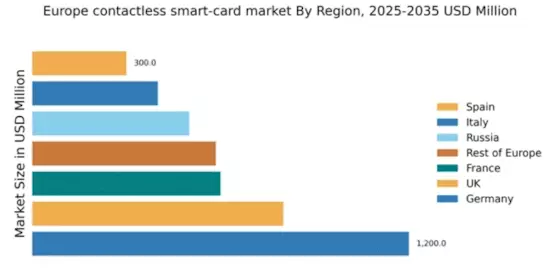

Expansion of Public Transportation Systems

The expansion of public transportation systems across Europe is a significant driver for the contactless smart-card market. Many cities are adopting contactless smart cards as a means of streamlining fare collection and improving the overall travel experience. For instance, cities like London and Paris have successfully implemented contactless payment systems for public transport, resulting in increased efficiency and reduced wait times for passengers. This trend is likely to continue, with investments in smart transportation infrastructure projected to reach €5 billion by 2028. As public transport authorities recognize the benefits of contactless technology, the contactless smart-card market is expected to see substantial growth. The integration of these cards into public transport systems not only enhances user convenience but also promotes the broader adoption of contactless payment solutions in everyday life.

Regulatory Support for Digital Payment Solutions

The European Union's regulatory framework is increasingly supportive of digital payment solutions, which serves as a catalyst for the contactless smart-card market. Initiatives aimed at promoting cashless transactions and enhancing payment security are being implemented across member states. For example, the EU's Payment Services Directive 2 (PSD2) encourages innovation and competition in the payment sector, thereby facilitating the adoption of contactless smart cards. This regulatory environment not only boosts consumer confidence but also incentivizes businesses to invest in contactless technologies. As a result, the contactless smart-card market is likely to experience accelerated growth, with market analysts projecting a potential increase in market penetration of up to 40% by 2027. Such regulatory support is crucial for fostering a secure and efficient payment ecosystem in Europe.

Technological Advancements in Card Manufacturing

Innovations in card manufacturing technology are significantly influencing the contactless smart-card market. The introduction of advanced materials and production techniques has led to the development of more durable and secure cards. For instance, the integration of NFC (Near Field Communication) technology has enhanced the functionality of contactless smart cards, making them more appealing to consumers and businesses alike. In Europe, manufacturers are investing heavily in R&D to create cards that not only meet security standards but also offer additional features such as loyalty programs and multi-currency capabilities. This technological evolution is expected to drive the market forward, with estimates suggesting a compound annual growth rate (CAGR) of 15% over the next five years. Consequently, the contactless smart-card market is poised for substantial expansion as these innovations become mainstream.