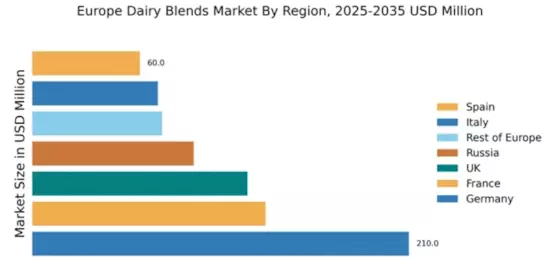

Germany : Strong Demand and Innovation Drive Growth

Key markets include North Rhine-Westphalia and Bavaria, where major dairy processing facilities are located. The competitive landscape features significant players like Müller and FrieslandCampina, which dominate the market with innovative product offerings. Local dynamics are characterized by a strong emphasis on quality and sustainability, with consumers increasingly favoring organic and locally sourced products. The food service sector, particularly in urban areas, is a significant application area for dairy blends, driving further growth.

UK : Health Trends Shape Market Dynamics

Key markets include London and Manchester, where consumer trends are rapidly changing. The competitive landscape features major players like Arla Foods and Danone, which are adapting to the growing demand for dairy alternatives. Local market dynamics are influenced by a vibrant food service sector, with cafes and restaurants increasingly offering dairy blend options. The rise of e-commerce is also transforming distribution channels, making dairy blends more accessible to consumers.

France : Culinary Heritage Meets Modern Trends

Key markets include Île-de-France and Rhône-Alpes, where culinary innovation thrives. The competitive landscape is robust, with players like Lactalis and Danone leading the charge in product development. Local dynamics are characterized by a strong emphasis on quality and tradition, with consumers willing to pay a premium for artisanal dairy blends. The food service industry, particularly in fine dining, is a significant application area, driving demand for unique dairy blend offerings.

Russia : Dairy Blends Gaining Popularity

Key markets include Moscow and St. Petersburg, where urban consumers are driving demand. The competitive landscape is evolving, with local players and international brands like Fonterra entering the market. Local dynamics are influenced by a diverse consumer base, with a rising middle class seeking quality dairy products. The retail sector, particularly supermarkets, plays a crucial role in distributing dairy blends, making them more accessible to consumers.

Italy : Dairy Blends in Italian Cuisine

Key markets include Lombardy and Emilia-Romagna, known for their rich dairy heritage. The competitive landscape features local players like Parmalat and international brands like Lactalis. Local dynamics are characterized by a strong preference for quality and authenticity, with consumers favoring traditional dairy blends. The food service sector, particularly in restaurants and catering, is a significant application area, driving further growth in the market.

Spain : Health-Conscious Consumers Drive Demand

Key markets include Catalonia and Madrid, where urban consumers are increasingly seeking diverse dairy options. The competitive landscape features local players and international brands like Danone, which are adapting to changing consumer preferences. Local dynamics are influenced by a vibrant food culture, with dairy blends being incorporated into various culinary applications. The retail sector, particularly supermarkets, plays a crucial role in making dairy blends accessible to consumers.

Rest of Europe : Regional Variations in Dairy Consumption

Key markets include countries like Belgium and the Netherlands, where dairy consumption is traditionally high. The competitive landscape features a mix of local and international players, with brands like FrieslandCampina and Arla Foods having a significant presence. Local dynamics vary widely, with some regions favoring traditional dairy products while others embrace innovative blends. The food service sector is a crucial application area, driving demand for diverse dairy blend offerings.