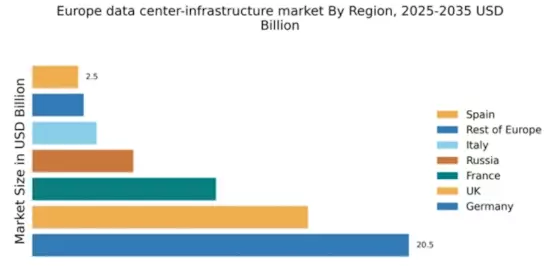

Germany : Robust Infrastructure and Innovation Hub

Germany holds a commanding 20.5% market share in the European data center infrastructure sector, driven by its advanced technological landscape and strong demand for cloud services. Key growth drivers include the increasing adoption of AI and IoT technologies, alongside supportive government initiatives promoting digital transformation. Regulatory frameworks, such as the GDPR, ensure data protection, fostering consumer trust and driving market expansion. The country’s robust infrastructure, including high-speed internet and energy-efficient facilities, further supports growth.

UK : Innovation and Investment at Forefront

London, Manchester, and Birmingham are pivotal markets, hosting numerous data centers and tech firms. The competitive landscape features major players like AWS, Microsoft, and Google Cloud, all vying for market share. The local business environment is characterized by a strong startup culture and significant investments in technology, particularly in fintech and e-commerce sectors.

France : Strategic Location and Growth Potential

Key markets include Paris, Lyon, and Marseille, which are home to numerous data centers and tech startups. The competitive landscape features significant players like IBM and Oracle, alongside local firms. The business environment is dynamic, with a focus on sectors such as e-commerce, gaming, and telecommunications, driving demand for data center services.

Russia : Regulatory Landscape and Infrastructure Needs

Moscow and St. Petersburg are key markets, hosting a mix of local and international data center providers. The competitive landscape is evolving, with players like NTT Communications establishing a presence. The local business environment is influenced by geopolitical factors, but sectors such as finance and telecommunications are driving demand for data center services.

Italy : Investment in Digital Transformation

Key markets include Milan, Rome, and Turin, where major data centers are located. The competitive landscape features players like Equinix and Digital Realty, alongside local firms. The business environment is improving, with a focus on sectors such as manufacturing and retail, which are increasingly relying on data center services.

Spain : Investment and Infrastructure Development

Key markets include Madrid and Barcelona, which are becoming hubs for data center development. The competitive landscape features both local and international players, with significant investments from firms like AWS and Google Cloud. The local business environment is vibrant, with sectors such as tourism and finance increasingly relying on data center capabilities.

Rest of Europe : Varied Growth Across Sub-regions

Key markets include the Nordics, Benelux, and Eastern Europe, each with unique characteristics. The competitive landscape features a mix of local and international players, with significant investments in green technology and energy-efficient data centers. The local business environment is influenced by sector-specific demands, including finance, healthcare, and e-commerce.