Emergence of Edge Computing

The rise of edge computing is reshaping the landscape of the data center-life-cycle-services market in Europe. As organizations seek to process data closer to the source, the demand for localized data centers is increasing. This trend necessitates specialized life-cycle services to manage the unique challenges associated with edge deployments. By 2025, it is anticipated that the edge computing market in Europe will surpass €20 billion, creating new opportunities for service providers. The need for efficient installation, maintenance, and optimization of edge data centers is likely to drive the demand for life-cycle services. Consequently, the data center-life-cycle-services market is expected to adapt and evolve to meet the requirements of this burgeoning segment.

Rising Cybersecurity Concerns

Cybersecurity remains a paramount concern for organizations operating data centers in Europe, significantly influencing the data center-life-cycle-services market. As cyber threats become increasingly sophisticated, businesses are compelled to invest in robust security measures throughout the data center life cycle. In 2025, the cybersecurity market in Europe is projected to reach €40 billion, underscoring the urgency for comprehensive security solutions. Life-cycle services that encompass risk assessment, threat detection, and incident response are becoming essential for safeguarding sensitive data. This heightened focus on cybersecurity is likely to drive demand for specialized life-cycle services, thereby contributing to the growth of the data center-life-cycle-services market.

Growing Demand for Cloud Services

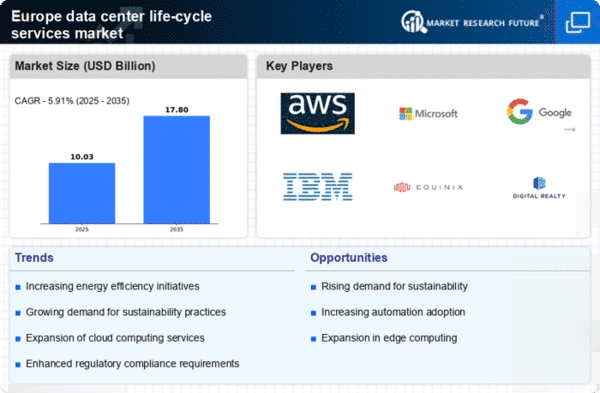

The increasing reliance on cloud computing is a pivotal driver for the data center-life-cycle-services market in Europe. As businesses transition to cloud-based solutions, the need for efficient data center management becomes paramount. In 2025, the cloud services market in Europe is projected to reach approximately €100 billion, indicating a robust growth trajectory. This surge necessitates enhanced life-cycle services to ensure optimal performance, security, and scalability of data centers. Companies are investing in life-cycle services to manage the complexities associated with cloud integration, including migration, maintenance, and optimization. Consequently, the data center-life-cycle-services market is likely to experience significant expansion as organizations seek to leverage cloud technologies while maintaining operational efficiency.

Increased Focus on Energy Efficiency

Energy efficiency has emerged as a critical concern for data centers in Europe, driving the demand for life-cycle services. With energy costs rising and environmental regulations tightening, organizations are compelled to adopt sustainable practices. The data center-life-cycle-services market is responding to this trend by offering solutions that optimize energy consumption. In 2025, it is estimated that energy-efficient data centers could reduce operational costs by up to 30%. This shift not only aligns with corporate sustainability goals but also enhances the overall performance of data centers. As a result, service providers are increasingly focusing on energy-efficient technologies and practices, thereby propelling the growth of the data center-life-cycle-services market.

Technological Integration and Automation

The integration of advanced technologies and automation is transforming the operational landscape of data centers in Europe, serving as a key driver for the data center-life-cycle-services market. Organizations are increasingly adopting automation tools to enhance efficiency, reduce human error, and streamline operations. By 2025, it is estimated that automation technologies could improve data center operational efficiency by up to 25%. This trend necessitates life-cycle services that support the implementation and management of these technologies. As businesses seek to leverage automation for improved performance, the demand for specialized life-cycle services is likely to rise, thereby propelling the growth of the data center-life-cycle-services market.