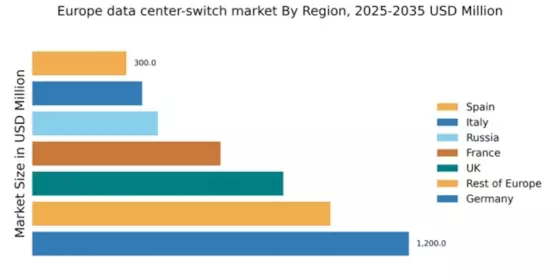

Germany : Strong Infrastructure and Innovation Hub

Key markets include Berlin, Frankfurt, and Munich, which are pivotal for data center operations. The competitive landscape features major players like Cisco Systems, Arista Networks, and Juniper Networks, all vying for market share. The local business environment is characterized by a strong emphasis on sustainability and innovation, with significant investments in green technologies. Industries such as e-commerce and telecommunications are driving sector-specific applications.

UK : Innovation and Investment Drive Market

Key markets include London, Manchester, and Birmingham, which are central to data center operations. The competitive landscape features players like Dell Technologies and Hewlett Packard Enterprise, with a focus on cutting-edge technology. The local business environment is dynamic, with a strong emphasis on fintech and media sectors driving demand for data center services. The UK is also seeing a rise in edge computing applications.

France : Strategic Location and Growth Potential

Key markets include Paris, Lyon, and Marseille, which are vital for data center development. The competitive landscape features major players like Nokia and Huawei Technologies, focusing on innovation and sustainability. The local business environment is favorable, with a growing emphasis on smart city initiatives and digital transformation across various industries, enhancing the demand for data center solutions.

Russia : Investment and Infrastructure Development

Key markets include Moscow and St. Petersburg, which are central to data center operations. The competitive landscape features local players alongside international firms like Cisco Systems. The business environment is evolving, with significant investments in infrastructure and technology, particularly in sectors like finance and e-commerce, driving demand for data center services.

Italy : Strategic Growth in Key Cities

Key markets include Milan, Rome, and Turin, which are essential for data center operations. The competitive landscape features players like Arista Networks and Dell Technologies, focusing on innovative solutions. The local business environment is characterized by a growing emphasis on digital transformation across various sectors, including manufacturing and retail, enhancing the demand for data center services.

Spain : Growth Driven by Digital Transformation

Key markets include Madrid and Barcelona, which are pivotal for data center development. The competitive landscape features players like Extreme Networks and Cisco Systems, focusing on innovative technologies. The local business environment is dynamic, with a strong emphasis on digital transformation across various industries, enhancing the demand for data center solutions.

Rest of Europe : Varied Growth Across Sub-regions

Key markets include cities across Scandinavia, Benelux, and Eastern Europe, which are essential for data center operations. The competitive landscape features a mix of local and international players, focusing on innovative solutions. The local business environment is characterized by a growing emphasis on sustainability and digital transformation across various sectors, enhancing the demand for data center services.