Increased Data Volume

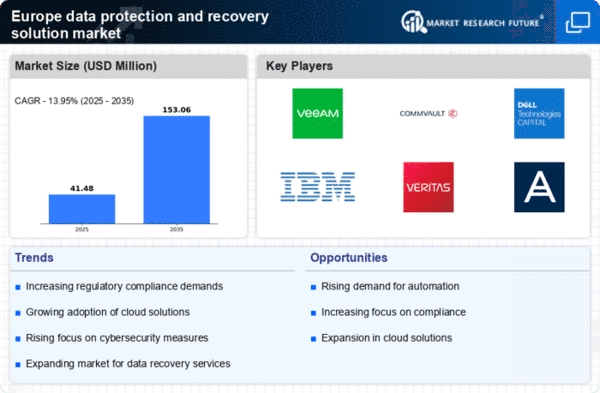

The exponential growth of data generated by businesses in Europe is a critical driver for the data protection-recovery-solution market. With the volume of data expected to increase by 30% annually, organizations are recognizing the necessity of implementing effective data management and recovery solutions. This surge in data volume complicates the landscape for data protection, as traditional methods may no longer suffice. Consequently, businesses are investing in innovative recovery solutions that can handle large datasets efficiently. The data protection-recovery-solution market is projected to grow as companies seek to ensure data integrity and availability amidst this data explosion. The challenge of managing vast amounts of information necessitates advanced technologies, which could lead to a significant transformation in the market landscape.

Shift Towards Remote Work

The shift towards remote work in Europe has created new challenges for data protection, thereby influencing the data protection-recovery-solution market. As more employees work from home, organizations face increased risks related to data security and access. This trend has led to a growing demand for solutions that can secure remote access to sensitive information. It is estimated that the market will grow by approximately 15% as businesses seek to implement effective data protection measures tailored for remote work environments. The need for secure data recovery solutions is becoming paramount as organizations strive to maintain productivity while safeguarding their data assets. This evolving work landscape is likely to drive innovation and investment in the data protection-recovery-solution market, as companies adapt to the new normal.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the data protection-recovery-solution market in Europe. Innovations such as machine learning, blockchain, and advanced encryption techniques are enhancing the effectiveness of data recovery solutions. As organizations seek to leverage these technologies, the market is expected to witness a growth rate of around 20% over the next few years. These advancements not only improve the speed and efficiency of data recovery processes but also bolster security measures against potential threats. The integration of cutting-edge technologies into data protection strategies is becoming increasingly essential for businesses aiming to stay competitive. Consequently, the data protection-recovery-solution market is likely to evolve rapidly, driven by the need for organizations to adopt state-of-the-art solutions that address emerging challenges.

Rising Cybersecurity Threats

The data protection-recovery-solution market in Europe is experiencing heightened demand due to the increasing frequency and sophistication of cyberattacks. Organizations are compelled to invest in robust data protection measures to safeguard sensitive information. In 2025, it is estimated that cybercrime will cost European businesses over €200 billion annually, prompting a shift towards comprehensive recovery solutions. This trend indicates that companies are prioritizing data security, leading to a surge in the adoption of advanced recovery technologies. The need for effective data protection strategies is further underscored by the growing awareness of potential financial losses and reputational damage associated with data breaches. As a result, the data protection-recovery-solution market is likely to expand significantly, driven by the urgency to mitigate risks and ensure business continuity.

Growing Awareness of Data Privacy

In Europe, the increasing awareness of data privacy issues is significantly influencing the data protection-recovery-solution market. With regulations such as the General Data Protection Regulation (GDPR) setting stringent requirements for data handling, organizations are compelled to adopt comprehensive data protection strategies. The market is projected to grow by approximately 25% in the next few years as businesses strive to comply with these regulations. This heightened focus on data privacy not only drives demand for recovery solutions but also encourages organizations to invest in preventive measures to avoid potential fines and legal repercussions. As consumers become more conscious of their data rights, companies are likely to prioritize transparency and accountability in their data management practices, further propelling the growth of the data protection-recovery-solution market.