Increasing Data Volume

The exponential growth of data generated across various sectors in Europe is a primary driver for the data recovery-software market. As organizations increasingly rely on digital platforms for operations, the volume of data stored continues to rise. Reports indicate that data generation in Europe is expected to reach 100 zettabytes by 2025. This surge necessitates robust data management solutions, including recovery software, to mitigate risks associated with data loss. Consequently, businesses are investing in data recovery solutions to ensure operational continuity and safeguard critical information. The data recovery-software market is thus positioned to benefit from this trend, as companies seek to protect their growing data assets from potential threats.

Evolving Regulatory Landscape

The evolving regulatory environment in Europe, particularly concerning data protection and privacy, is a crucial driver for the data recovery-software market. With regulations such as the General Data Protection Regulation (GDPR) imposing strict requirements on data handling, organizations are compelled to implement robust data recovery solutions. Non-compliance can result in fines reaching up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory pressure encourages businesses to adopt comprehensive data recovery strategies to ensure compliance and protect sensitive information. As a result, the data recovery-software market is likely to see increased demand as organizations prioritize compliance and data integrity.

Rising Incidence of Data Loss

The frequency of data loss incidents, whether due to hardware failures, accidental deletions, or cyberattacks, is a significant factor propelling the data recovery-software market. In Europe, studies suggest that approximately 30% of businesses experience data loss annually, leading to substantial financial repercussions. The average cost of data loss for organizations can reach up to €1.5 million, highlighting the urgent need for effective recovery solutions. As awareness of these risks increases, companies are more inclined to invest in data recovery software to minimize downtime and recover lost data swiftly. This trend underscores the critical role of the data recovery-software market in providing solutions that address the growing challenges of data loss.

Growing Awareness of Data Security

There is a notable increase in awareness regarding data security among businesses in Europe, which is driving the demand for data recovery software. Organizations are recognizing that data breaches and loss can have severe implications, not only financially but also in terms of reputation. Surveys indicate that over 60% of European companies consider data security a top priority, leading to heightened investments in data protection measures, including recovery solutions. This growing consciousness about safeguarding data assets is likely to bolster the data recovery-software market, as companies seek reliable solutions to recover lost data and maintain operational integrity.

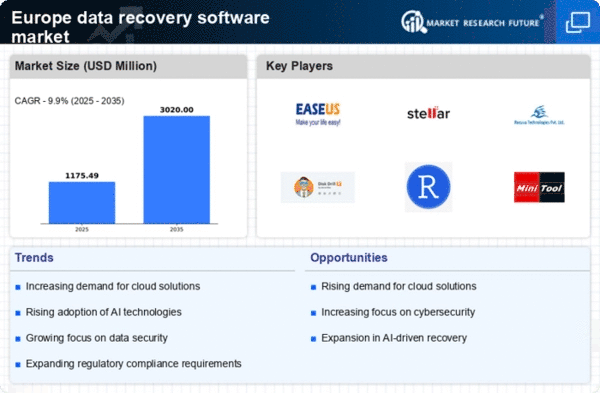

Technological Innovations in Recovery Tools

Technological advancements in recovery tools are significantly influencing the data recovery-software market. Innovations such as artificial intelligence and machine learning are enhancing the efficiency and effectiveness of recovery solutions. These technologies enable faster data retrieval and improved accuracy in recovery processes. In Europe, the integration of such advanced technologies is expected to drive market growth, as businesses seek cutting-edge solutions to address their data recovery needs. The data recovery-software market is thus poised to benefit from these innovations, as organizations increasingly adopt sophisticated tools to enhance their data management capabilities.