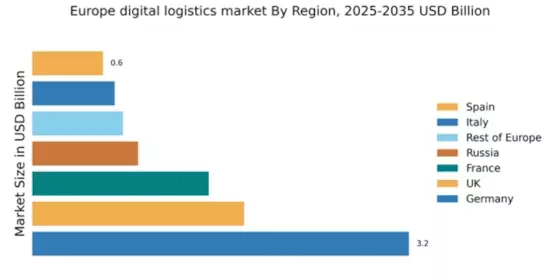

Germany : Innovation Drives Market Growth

Germany holds a commanding 3.2% market share in the European digital logistics sector, valued at approximately €10 billion. Key growth drivers include advanced technology adoption, robust e-commerce demand, and government initiatives promoting digital infrastructure. Regulatory policies favoring sustainability and efficiency are also pivotal, alongside significant investments in logistics infrastructure, particularly in urban areas like Berlin and Munich.

UK : E-commerce Fuels Demand Surge

The UK accounts for 1.8% of the European digital logistics market, valued at around €5.5 billion. The surge in e-commerce, particularly in cities like London and Manchester, is a primary growth driver. Government policies supporting digital transformation and infrastructure improvements are enhancing market dynamics. The demand for last-mile delivery solutions is also rising, influenced by changing consumer behaviors and preferences.

France : Diverse Market Opportunities Ahead

France's digital logistics market represents 1.5% of the European total, with a value nearing €4.5 billion. Growth is driven by increasing online retail activity and government support for digital initiatives. The logistics sector benefits from France's strategic location and well-developed transport networks, particularly in regions like Île-de-France and Provence-Alpes-Côte d'Azur. Regulatory frameworks are evolving to support innovation and sustainability.

Russia : Infrastructure Development Key Focus

Russia holds a 0.9% share of the European digital logistics market, valued at approximately €2.7 billion. Key growth drivers include expanding e-commerce and significant investments in logistics infrastructure, particularly in Moscow and St. Petersburg. Government initiatives aimed at modernizing transport networks and enhancing digital capabilities are crucial. However, regulatory challenges and market fragmentation remain hurdles to growth.

Italy : Cultural Shifts Influence Demand

Italy's digital logistics market accounts for 0.7% of the European share, valued at about €2.1 billion. Growth is spurred by increasing online shopping and a shift towards digital solutions in logistics. Key cities like Milan and Rome are central to this transformation. The competitive landscape features major players like DHL and UPS, while local businesses adapt to changing consumer preferences and regulatory frameworks.

Spain : Logistics Adapting to New Norms

Spain represents 0.6% of the European digital logistics market, valued at approximately €1.8 billion. The rise of e-commerce, particularly in urban areas like Madrid and Barcelona, is a significant growth driver. Government initiatives supporting digital logistics and infrastructure improvements are enhancing market conditions. The competitive landscape includes both local and international players, adapting to evolving consumer demands.

Rest of Europe : Regional Variations in Growth

The Rest of Europe accounts for 0.77% of the digital logistics market, valued at around €2.3 billion. Growth varies significantly across countries, influenced by local e-commerce trends and regulatory environments. Countries like the Netherlands and Belgium are emerging as logistics hubs due to their strategic locations and advanced infrastructure. The competitive landscape features a mix of local and international players, each adapting to regional demands.