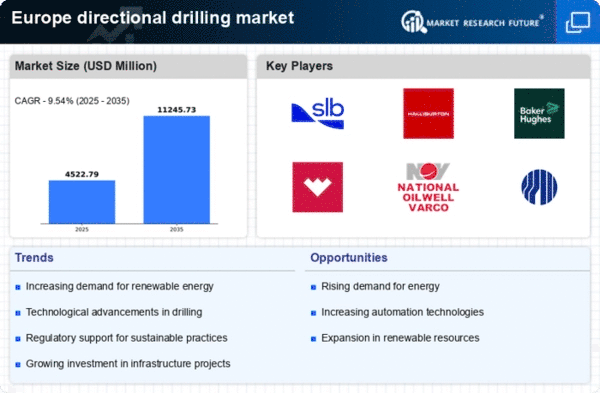

The directional drilling market in Europe is characterized by a competitive landscape that is increasingly shaped by technological advancements and strategic partnerships. Key growth drivers include the rising demand for efficient drilling techniques, the need for enhanced resource recovery, and the ongoing transition towards sustainable energy practices. Major players such as Schlumberger (US), Halliburton (US), and Baker Hughes (US) are at the forefront, focusing on innovation and digital transformation to maintain their competitive edge. Their strategies, which encompass mergers and acquisitions, regional expansion, and the integration of advanced technologies, collectively influence the market dynamics, fostering a more competitive environment.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a diverse range of offerings, yet the collective strength of these major companies shapes the competitive landscape, driving innovation and setting industry standards.

In October 2025, Schlumberger (US) announced a strategic partnership with a leading technology firm to develop AI-driven drilling solutions aimed at improving operational efficiency and reducing costs. This move underscores Schlumberger's commitment to leveraging cutting-edge technology to enhance its service offerings, potentially positioning the company as a leader in the digital transformation of the industry. The integration of AI into drilling operations may lead to significant advancements in predictive maintenance and real-time data analytics.

In September 2025, Halliburton (US) launched a new suite of digital tools designed to optimize drilling performance and reduce non-productive time. This initiative reflects Halliburton's focus on innovation and its efforts to provide clients with enhanced operational capabilities. By investing in digital solutions, Halliburton aims to differentiate itself in a competitive market, potentially leading to improved customer satisfaction and loyalty.

In August 2025, Baker Hughes (US) expanded its operations in Eastern Europe by acquiring a local drilling services company. This acquisition not only strengthens Baker Hughes' market presence but also enhances its ability to offer localized services tailored to regional needs. Such strategic moves indicate a trend towards consolidation in the market, where companies seek to bolster their competitive positioning through targeted acquisitions.

As of November 2025, current competitive trends in the directional drilling market include a pronounced emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition towards a focus on technological advancements, innovation, and supply chain reliability. This transition may redefine how companies compete, emphasizing the importance of delivering value through enhanced service offerings and operational excellence.