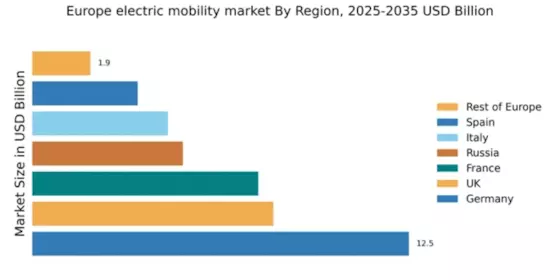

Germany : Germany's Dominance in Electric Mobility

Germany holds a commanding 12.5% market share in the European electric mobility sector, valued at approximately €10 billion. Key growth drivers include robust government incentives, stringent emissions regulations, and a strong automotive industry pivoting towards electric vehicles (EVs). Demand is surging, particularly in urban areas, as consumers increasingly favor sustainable transport options. The government has implemented initiatives like the National Strategy for Electric Mobility, aiming for 1 million charging stations by 2030, enhancing infrastructure significantly.

UK : Government Support Fuels Growth

The UK electric mobility market commands an 8.0% share, valued at around €6 billion. Growth is driven by government grants for EV purchases, a commitment to ban petrol and diesel cars by 2030, and increasing consumer awareness of environmental issues. Demand is particularly high in metropolitan areas like London and Manchester, where charging infrastructure is expanding rapidly. The UK government is investing heavily in charging networks, aiming for 300,000 charging points by 2030, which is crucial for market expansion.

France : Sustainable Transport Takes Center Stage

France holds a 7.5% market share in the electric mobility sector, valued at approximately €5.5 billion. The growth is propelled by government incentives, such as the ecological bonus for EV purchases, and a strong push towards reducing carbon emissions. Urban areas like Paris are seeing a rise in EV adoption, supported by extensive charging infrastructure. The French government aims to have 1 million charging stations by 2025, enhancing accessibility and convenience for consumers.

Russia : Russia's Slow but Steady Growth

With a 5.0% market share, Russia's electric mobility market is valued at around €3.5 billion. Growth drivers include increasing government interest in sustainable transport and the development of local EV manufacturing. Demand is gradually rising, particularly in cities like Moscow and St. Petersburg, where charging infrastructure is being developed. The Russian government is exploring incentives for EV purchases, although the market remains heavily reliant on traditional vehicles, presenting challenges for rapid growth.

Italy : Cultural Shift Towards Electric Vehicles

Italy's electric mobility market holds a 4.5% share, valued at approximately €3 billion. Key growth drivers include government incentives for EV purchases and a cultural shift towards sustainability. Demand is particularly strong in urban centers like Milan and Rome, where charging infrastructure is being expanded. The Italian government has set ambitious targets for EV adoption, aiming for 6 million electric vehicles by 2030, which is expected to significantly boost market growth.

Spain : Investment in Infrastructure and Incentives

Spain's electric mobility market accounts for a 3.5% share, valued at around €2.5 billion. Growth is driven by government incentives for EV purchases and investments in charging infrastructure. Cities like Madrid and Barcelona are leading the charge, with increasing numbers of charging stations. The Spanish government has committed to a national plan for sustainable mobility, aiming for 5 million electric vehicles by 2030, which will enhance market dynamics and consumer confidence.

Rest of Europe : Varied Growth in Smaller Markets

The Rest of Europe holds a 1.93% market share, valued at approximately €1.4 billion. Growth drivers vary by country, with some nations focusing on government incentives while others emphasize infrastructure development. Demand trends are influenced by local regulations and consumer preferences, with countries like Norway leading in EV adoption. The competitive landscape includes both local and international players, with a focus on niche markets and specific applications, such as public transport electrification.