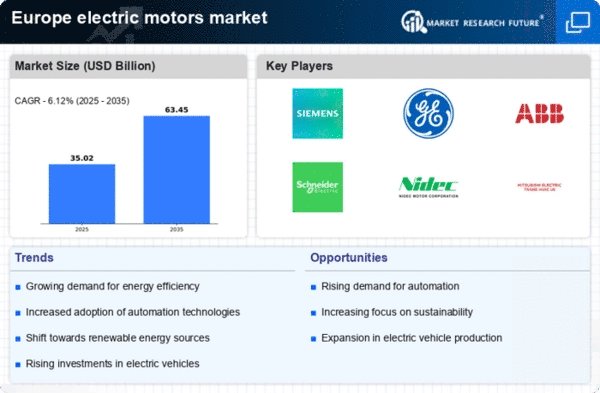

Growth of Electric Vehicles (EVs)

The electric vehicles (EVs) sector is emerging as a significant driver for the electric motors market in Europe. With the European automotive industry undergoing a transformation towards electrification, the demand for high-performance electric motors is escalating. The European market for EVs is expected to grow at a CAGR of over 25% through 2028, driven by government incentives and consumer preferences for sustainable transportation. This growth is likely to create substantial opportunities for electric motor manufacturers, as they cater to the increasing need for efficient and reliable motors in EV applications. The electric motors market is thus positioned to capitalize on this burgeoning trend.

Rising Demand for Renewable Energy

The transition towards renewable energy sources is a pivotal driver for the electric motors market in Europe. As countries strive to meet ambitious climate targets, the demand for electric motors in wind turbines, solar energy systems, and other renewable applications is surging. The European Commission's Green Deal aims to make Europe the first climate-neutral continent by 2050, which is likely to further accelerate investments in renewable energy infrastructure. This shift is expected to increase the market share of electric motors used in renewable applications to approximately 30% by 2026. Consequently, the electric motors market is poised for substantial growth as it aligns with the broader energy transition goals.

Regulatory Compliance and Standards

The electric motors market in Europe is increasingly influenced by stringent regulatory frameworks aimed at enhancing energy efficiency and reducing carbon emissions. The European Union has implemented directives that mandate compliance with specific energy efficiency standards, such as the Ecodesign Directive. This regulatory environment compels manufacturers to innovate and produce electric motors that meet or exceed these standards. As a result, the market is witnessing a shift towards high-efficiency motors, which are projected to account for over 70% of the total market by 2027. Compliance with these regulations not only drives technological advancements but also positions companies favorably in a competitive landscape, thereby fostering growth in the electric motors market.

Investment in Infrastructure Development

Investment in infrastructure development across Europe is a critical driver for the electric motors market. As governments and private sectors allocate substantial funds towards upgrading and expanding infrastructure, the demand for electric motors in various applications, including transportation, construction, and utilities, is expected to rise. The European Investment Bank has earmarked €500 billion for infrastructure projects over the next decade, which will likely stimulate growth in the electric motors market. This influx of investment not only enhances the operational capabilities of existing systems but also fosters innovation in motor technologies, thereby contributing to the overall expansion of the market.

Industrial Automation and Smart Manufacturing

The ongoing trend towards industrial automation and smart manufacturing is significantly impacting the electric motors market in Europe. As industries adopt advanced technologies such as IoT and AI, the demand for electric motors that can integrate seamlessly into automated systems is rising. This trend is reflected in the increasing investments in automation technologies, which are projected to reach €200 billion by 2025. Electric motors play a crucial role in enhancing operational efficiency and productivity in manufacturing processes. The electric motors market is thus likely to benefit from this shift, as manufacturers seek to optimize their operations through the deployment of intelligent motor systems.