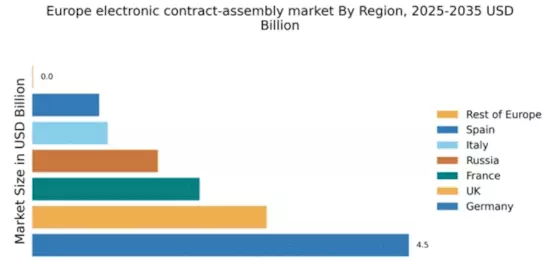

Germany : Strong Demand and Innovation Hub

Germany holds a commanding 4.5% market share in the electronic contract-assembly sector, valued at approximately €1.5 billion. Key growth drivers include a robust industrial base, increasing digitalization, and supportive government initiatives promoting e-governance. Demand trends show a shift towards automated solutions, with businesses seeking efficiency and compliance. Regulatory frameworks, such as the eIDAS regulation, bolster trust in electronic signatures, while significant investments in digital infrastructure enhance accessibility.

UK : Innovative Solutions for Businesses

The UK boasts a 2.8% market share in the electronic contract-assembly market, valued at around €900 million. Growth is driven by the increasing adoption of digital solutions across various sectors, particularly in finance and legal services. The UK government has implemented policies to encourage digital transformation, including the Digital Economy Act. Demand for secure and efficient contract management solutions is rising, reflecting a shift in consumption patterns towards cloud-based services.

France : Regulatory Support and Adoption

France captures a 2.0% market share in the electronic contract-assembly market, valued at approximately €700 million. The growth is fueled by regulatory support, including the French Digital Republic Act, which promotes the use of electronic signatures. Demand is increasing in sectors like real estate and e-commerce, where efficiency and speed are critical. The French government is actively encouraging digital transformation, enhancing infrastructure to support e-contract solutions.

Russia : Market Potential and Challenges

Russia holds a 1.5% market share in the electronic contract-assembly market, valued at about €500 million. Key growth drivers include a rising interest in digital solutions and government initiatives aimed at modernizing business practices. However, regulatory challenges and varying levels of digital literacy can hinder adoption. Demand is particularly strong in urban centers like Moscow and St. Petersburg, where businesses are increasingly seeking efficient contract management solutions.

Italy : Focus on Digital Transformation

Italy has a 0.9% market share in the electronic contract-assembly market, valued at approximately €300 million. Growth is driven by the Italian government's push for digitalization through initiatives like the Digital Agenda. Demand trends indicate a growing acceptance of electronic signatures, particularly in sectors such as manufacturing and services. However, regional disparities in infrastructure development can affect market penetration, especially in rural areas.

Spain : Adoption Driven by Innovation

Spain captures a 0.8% market share in the electronic contract-assembly market, valued at around €250 million. The market is evolving due to increasing awareness of digital solutions and government support for e-signatures. Key growth drivers include the rise of startups and SMEs seeking efficient contract management. Major cities like Madrid and Barcelona are leading the charge, with a competitive landscape featuring both local and international players.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe holds a minimal 0.01% market share in the electronic contract-assembly market, valued at approximately €3 million. Despite the small size, there are niche opportunities driven by local demand for digital solutions. Regulatory environments vary significantly, impacting adoption rates. Countries like Belgium and the Netherlands show potential for growth, particularly in sectors like logistics and technology, where efficiency is paramount.