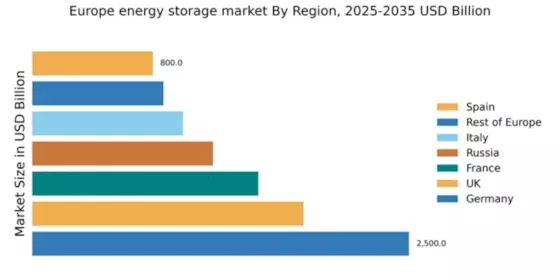

Germany : Germany's Robust Market Dynamics

Germany holds a commanding 30% market share in the European energy storage sector, valued at $2,500.0 million. Key growth drivers include the country's ambitious renewable energy targets, supported by government incentives like the Renewable Energy Sources Act (EEG). The increasing demand for energy storage solutions is fueled by the rise in solar and wind energy installations, alongside a growing focus on energy independence and sustainability. Infrastructure investments in smart grids further enhance market potential.

UK : UK's Energy Transition Journey

The UK commands an 18% market share, valued at $1,800.0 million, driven by government policies promoting low-carbon technologies. The Energy White Paper outlines ambitious targets for energy storage, aiming for a significant reduction in carbon emissions. Demand is rising due to increased electric vehicle adoption and the need for grid stability. The UK is also witnessing a shift towards decentralized energy systems, enhancing the appeal of storage solutions.

France : France's Diverse Energy Landscape

France holds a 15% market share, valued at $1,500.0 million, bolstered by its nuclear energy base and growing renewable sector. The French government supports energy storage through initiatives like the Multiannual Energy Program (PPE), which aims to diversify energy sources. Demand is driven by the need for grid flexibility and integration of renewable energy. The market is characterized by a strong focus on R&D and innovation in energy technologies.

Russia : Russia's Resource-Rich Market

Russia captures a 12% market share, valued at $1,200.0 million, with growth driven by its vast natural resources and increasing energy consumption. Government initiatives aim to modernize the energy sector, promoting energy efficiency and sustainability. Demand trends indicate a rising interest in energy storage for both industrial and residential applications, particularly in urban centers like Moscow and St. Petersburg, where energy reliability is crucial.

Italy : Italy's Renewable Energy Push

Italy holds a 10% market share, valued at $1,000.0 million, driven by its commitment to renewable energy and energy efficiency. The Italian government has implemented policies to support energy storage, including incentives for solar energy systems. Demand is growing in regions like Lombardy and Lazio, where industrial applications are on the rise. The competitive landscape features local players alongside international giants, fostering innovation and collaboration.

Spain : Spain's Renewable Energy Revolution

Spain commands an 8% market share, valued at $800.0 million, with significant growth potential driven by its solar energy boom. The Spanish government has introduced favorable policies to encourage energy storage adoption, including subsidies for residential systems. Key markets include Andalusia and Catalonia, where solar installations are prevalent. The competitive landscape is marked by both local and international players, enhancing market dynamics.

Rest of Europe : Varied Energy Storage Landscape

The Rest of Europe holds a 7% market share, valued at $870.48 million, encompassing a mix of mature and emerging markets. Growth is driven by varying national policies and energy needs across countries. Demand trends show increasing interest in energy storage solutions, particularly in Eastern European nations. The competitive landscape features a blend of local and international players, each adapting to unique market conditions and regulatory environments.