Focus on Data Privacy Regulations

The enterprise communication-infrastructure market in Europe is profoundly shaped by the stringent data privacy regulations that govern how organizations manage and protect sensitive information. The General Data Protection Regulation (GDPR) has set a high standard for data handling practices, compelling businesses to adopt robust communication solutions that ensure compliance. As a result, companies are increasingly seeking communication tools that offer end-to-end encryption and secure data storage. It is estimated that compliance-related investments in communication infrastructure could reach €30 billion by 2025. This focus on data privacy not only drives demand for secure communication solutions but also encourages innovation among providers to develop compliant technologies that meet regulatory requirements, thereby influencing the overall landscape of the enterprise communication-infrastructure market.

Emergence of Unified Communication Solutions

The enterprise communication-infrastructure market in Europe is witnessing a significant shift towards unified communication solutions. These platforms integrate various communication channels, including voice, video, messaging, and collaboration tools, into a single interface. This trend is driven by the need for streamlined communication processes and improved operational efficiency. Recent studies indicate that organizations utilizing unified communication solutions report a 25% increase in productivity. As businesses recognize the value of having a cohesive communication strategy, the demand for such solutions is expected to rise. This shift not only enhances user experience but also fosters collaboration across teams, ultimately contributing to the growth of the enterprise communication-infrastructure market.

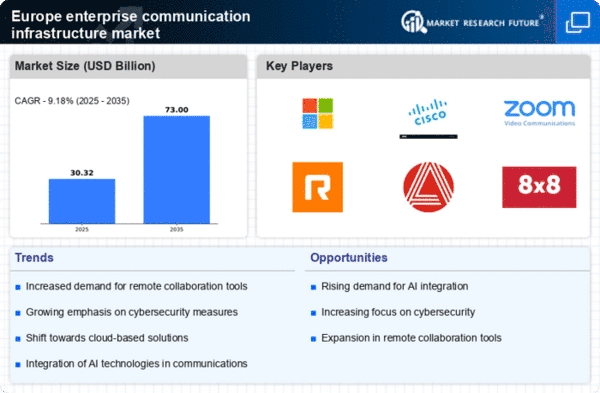

Rising Demand for Remote Collaboration Tools

The enterprise communication-infrastructure market in Europe experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for seamless communication solutions becomes paramount. Recent data indicates that approximately 70% of European companies are investing in advanced collaboration platforms to enhance productivity and employee engagement. This trend is likely to drive innovation within the market, as providers strive to offer integrated solutions that facilitate real-time communication, file sharing, and project management. Furthermore, the emphasis on user-friendly interfaces and mobile accessibility is expected to shape product development, ensuring that tools cater to diverse workforce needs. Consequently, the enterprise communication-infrastructure market is poised for growth as businesses prioritize effective collaboration in their operational strategies.

Investment in Network Infrastructure Upgrades

In Europe, the enterprise communication-infrastructure market is significantly influenced by the ongoing investment in network infrastructure upgrades. With the increasing reliance on high-speed internet and robust connectivity, organizations are allocating substantial budgets to enhance their communication frameworks. Reports suggest that the European telecommunications sector is projected to invest over €100 billion in network improvements by 2026. This investment is likely to facilitate the deployment of next-generation technologies, such as 5G, which can dramatically enhance communication capabilities. As a result, businesses are expected to benefit from improved bandwidth, reduced latency, and enhanced reliability, ultimately driving the demand for advanced communication solutions within the enterprise communication-infrastructure market.

Adoption of Advanced Analytics and Reporting Tools

The enterprise communication-infrastructure market in Europe is increasingly influenced by the adoption of advanced analytics and reporting tools. Organizations are recognizing the importance of data-driven decision-making in optimizing communication strategies. By leveraging analytics, businesses can gain insights into communication patterns, user engagement, and overall effectiveness of their communication infrastructure. It is projected that the market for analytics tools within the communication sector will grow by 15% annually through 2027. This trend encourages providers to develop sophisticated reporting features that enable organizations to track performance metrics and make informed adjustments. Consequently, the integration of analytics into communication solutions is likely to enhance the overall effectiveness and adaptability of the enterprise communication-infrastructure market.