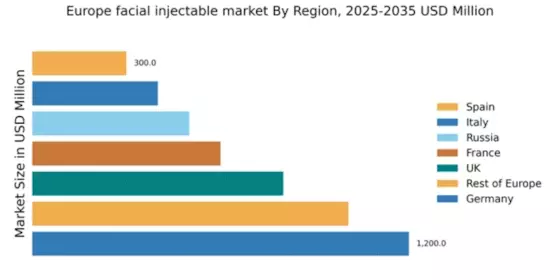

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant position in the European facial injectable market, accounting for approximately 30% of the total market share with a value of $1200.0 million. Key growth drivers include a rising demand for aesthetic procedures, increased consumer awareness, and a robust healthcare infrastructure. Regulatory policies favoring minimally invasive treatments and government initiatives promoting aesthetic medicine further bolster market growth. The country’s advanced industrial development supports innovation in product offerings.

UK : Increasing Popularity of Non-Surgical Options

The UK market for facial injectables is valued at $800.0 million, representing about 20% of the European market. Growth is fueled by a cultural shift towards non-surgical aesthetic treatments, with increasing acceptance among younger demographics. Regulatory frameworks are evolving to ensure safety and efficacy, while the presence of numerous aesthetic clinics enhances accessibility. The market is characterized by a high demand for hyaluronic acid-based products, reflecting consumer preferences for natural-looking results.

France : Diverse Applications and Strong Demand

France's facial injectable market is valued at $600.0 million, capturing around 15% of the European market. The growth is driven by a strong emphasis on aesthetic innovation and a diverse range of applications, from anti-aging to volume restoration. Regulatory bodies are actively involved in ensuring product safety, which boosts consumer confidence. The market is supported by a network of skilled practitioners and a growing number of aesthetic clinics, particularly in urban areas like Paris and Lyon.

Russia : Rapid Growth in Aesthetic Procedures

Russia's facial injectable market is valued at $500.0 million, accounting for about 12.5% of the European market. The sector is experiencing rapid growth due to increasing disposable incomes and a rising interest in aesthetic procedures among the population. Regulatory policies are becoming more structured, promoting safety and efficacy. Major cities like Moscow and St. Petersburg are key markets, with a competitive landscape featuring both local and international players, enhancing market dynamics.

Italy : Strong Demand for Facial Enhancements

Italy's facial injectable market is valued at $400.0 million, representing about 10% of the European market. The growth is driven by cultural acceptance of aesthetic treatments and a strong demand for facial enhancements among both men and women. Regulatory frameworks are supportive, ensuring product safety and efficacy. Key markets include Milan and Rome, where a high concentration of aesthetic clinics exists, fostering a competitive environment with major players like Galderma and Allergan.

Spain : Expanding Market with Diverse Offerings

Spain's facial injectable market is valued at $300.0 million, making up about 7.5% of the European market. The growth is attributed to an expanding interest in aesthetic medicine, particularly among younger consumers. Regulatory policies are adapting to the evolving market, ensuring safety and quality. Major cities like Barcelona and Madrid are key markets, with a competitive landscape featuring both local and international brands, enhancing consumer choice and market dynamics.

Rest of Europe : Varied Growth Across Multiple Regions

The Rest of Europe market for facial injectables is valued at $1007.3 million, accounting for approximately 25% of the total European market. This segment includes a variety of countries with unique market dynamics and growth drivers. Regulatory environments vary, influencing market accessibility and consumer confidence. Key markets include Scandinavia and Eastern Europe, where increasing disposable incomes and a growing interest in aesthetic treatments are driving demand. The competitive landscape features both established and emerging players.