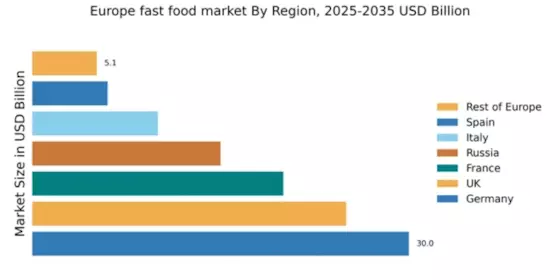

Germany : Strong Demand and Diverse Offerings

Germany holds a commanding 30.0% market share in Europe's fast food sector, valued at approximately €15 billion. Key growth drivers include a rising preference for convenience, health-conscious options, and digital ordering platforms. Regulatory policies promoting food safety and quality standards further enhance consumer trust. Infrastructure improvements, particularly in urban areas, facilitate faster service and delivery, catering to the growing demand for quick meals.

UK : Innovation and Variety Drive Growth

The UK fast food market accounts for 25.0% of the European share, valued at around €12 billion. Growth is fueled by innovative menu offerings, including plant-based options, and a strong delivery culture. Government initiatives supporting local businesses and food safety regulations play a crucial role in shaping the market. The rise of food delivery apps has transformed consumption patterns, making fast food more accessible than ever.

France : Gourmet Fast Food Trends Emerge

France captures 20.0% of the European fast food market, valued at approximately €10 billion. The growth is driven by a unique blend of traditional French cuisine with fast food concepts, appealing to both locals and tourists. Regulatory frameworks emphasize quality and sustainability, influencing consumer choices. The market is characterized by a strong café culture, with cities like Paris and Lyon leading in fast food innovation.

Russia : Emerging Trends and Local Flavors

With a 15.0% market share, Russia's fast food sector is valued at around €7.5 billion. Key growth drivers include urbanization, increasing disposable incomes, and a growing youth population. Government policies promoting foreign investment in the food sector have also contributed to market expansion. Local flavors are increasingly incorporated into menus, appealing to regional tastes and preferences.

Italy : Culinary Heritage Influences Market

Italy holds a 10.0% share of the European fast food market, valued at approximately €5 billion. The growth is driven by a unique fusion of traditional Italian cuisine with fast food formats, particularly in urban centers like Milan and Rome. Regulatory policies emphasize food quality and local sourcing, enhancing consumer confidence. The competitive landscape features both international chains and local brands, creating a diverse market environment.

Spain : Cultural Influences Shape Preferences

Spain accounts for 6.0% of the European fast food market, valued at around €3 billion. Growth is driven by a vibrant food culture and increasing demand for quick-service options. Regulatory frameworks support food safety and quality, while local preferences for tapas-style offerings influence menu designs. Major cities like Madrid and Barcelona are key markets, with a mix of international and local players competing for consumer attention.

Rest of Europe : Regional Variations and Opportunities

The Rest of Europe holds a 5.14% market share in the fast food sector, valued at approximately €2.5 billion. Growth is driven by increasing urbanization and changing consumer lifestyles across various countries. Regulatory policies vary significantly, impacting market dynamics. Countries like Belgium and the Netherlands are notable for their unique fast food offerings, with local chains gaining traction alongside international brands.