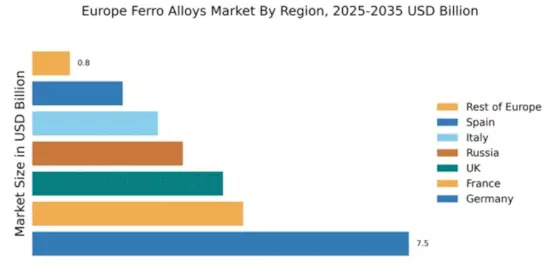

Germany : Strong industrial base drives growth

Germany holds a dominant market share of 7.5% in the European ferro alloys sector, valued at approximately €1.5 billion. Key growth drivers include a robust automotive industry, increasing demand for stainless steel, and government initiatives promoting sustainable manufacturing practices. Regulatory policies favoring green technologies and investments in infrastructure further enhance market potential. The country’s advanced industrial framework supports high consumption rates, particularly in the steel and construction sectors.

UK : Sustainable practices shape demand

The UK ferro alloys market accounts for 3.8% of the European share, valued at around €800 million. Growth is propelled by increasing investments in renewable energy and a shift towards electric vehicles, which require high-quality alloys. Regulatory frameworks are evolving to support low-carbon technologies, influencing consumption patterns. The UK government’s commitment to net-zero emissions by 2050 is a significant driver for the sector, fostering innovation in alloy production.

France : Diverse applications fuel demand

France captures 4.2% of the European ferro alloys market, valued at approximately €900 million. The growth is driven by diverse applications in aerospace, automotive, and construction industries. Government initiatives aimed at enhancing industrial competitiveness and sustainability are pivotal. Regulatory policies support research and development in alloy technologies, while infrastructure investments bolster production capabilities, ensuring steady demand in the market.

Russia : Resource-rich landscape supports growth

Russia holds a 3.0% market share in the European ferro alloys sector, valued at around €600 million. The country benefits from abundant natural resources, driving production capabilities. Key growth drivers include increasing domestic consumption and export opportunities to Europe. Regulatory policies are focused on enhancing mining efficiency and environmental sustainability. Infrastructure development in key regions like Siberia supports industrial growth and market expansion.

Italy : Manufacturing sector drives consumption

Italy represents 2.5% of the European ferro alloys market, valued at approximately €500 million. The growth is primarily driven by the manufacturing sector, particularly in automotive and machinery. Government initiatives promoting innovation and sustainability are crucial for market dynamics. Regulatory frameworks are evolving to support eco-friendly production methods, while regional investments in infrastructure enhance supply chain efficiency, fostering demand.

Spain : Industrial recovery boosts market potential

Spain accounts for 1.8% of the European ferro alloys market, valued at around €350 million. The market is experiencing growth due to industrial recovery post-pandemic, with increased demand in construction and automotive sectors. Government policies aimed at revitalizing manufacturing and promoting sustainable practices are key growth drivers. Regional investments in infrastructure, particularly in Catalonia and Madrid, support market expansion and consumption patterns.

Rest of Europe : Diverse opportunities across regions

The Rest of Europe holds a modest 0.75% market share in the ferro alloys sector, valued at approximately €150 million. Growth opportunities exist in niche markets, driven by local demand in specific industries such as electronics and renewable energy. Regulatory policies vary by country, influencing market dynamics. Infrastructure development in smaller nations supports industrial growth, while local players are adapting to global trends in alloy production.