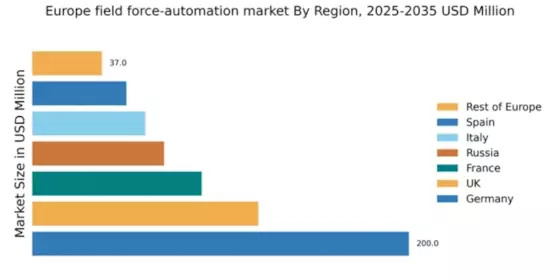

Germany : Strong Growth Driven by Innovation

Germany holds a commanding market share of 200.0, representing approximately 36.5% of the European field force-automation market. Key growth drivers include a robust industrial base, increasing demand for automation in logistics, and government initiatives promoting digital transformation. Regulatory policies favoring innovation and sustainability further enhance market potential. The country’s advanced infrastructure supports seamless integration of automation technologies, fostering a conducive environment for growth.

UK : Innovation and Adaptation at Forefront

The UK market, valued at 120.0, accounts for about 21.9% of the European field force-automation sector. Growth is driven by the increasing adoption of cloud-based solutions and a shift towards remote work. Demand trends indicate a rising need for real-time data analytics and customer engagement tools. Government initiatives aimed at enhancing digital skills and infrastructure are pivotal in this transformation, creating a favorable regulatory environment for tech adoption.

France : Strong Focus on Digitalization

France's market, valued at 90.0, represents approximately 16.4% of the European field force-automation landscape. The growth is fueled by a strong emphasis on digitalization across sectors, particularly in manufacturing and services. Demand for integrated solutions that enhance operational efficiency is on the rise. Government policies promoting innovation and investment in technology infrastructure are critical in shaping the market dynamics, fostering a supportive ecosystem for automation.

Russia : Market Potential with Unique Dynamics

Russia's field force-automation market, valued at 70.0, captures about 12.8% of the European share. Key growth drivers include increasing investments in technology and a push for modernization in various industries. However, regulatory challenges and economic fluctuations pose risks. Major cities like Moscow and St. Petersburg are pivotal markets, with local players competing alongside international giants. The demand for automation in sectors like energy and transportation is particularly strong, reflecting unique local dynamics.

Italy : Focus on Efficiency and Innovation

Italy's market, valued at 60.0, accounts for approximately 11.0% of the European field force-automation sector. Growth is driven by a focus on efficiency in manufacturing and logistics, with increasing demand for mobile workforce solutions. Regulatory support for digital transformation initiatives enhances market prospects. Key cities such as Milan and Turin are central to this growth, with a competitive landscape featuring both local and international players, particularly in the automotive and retail sectors.

Spain : Digital Transformation Gaining Momentum

Spain's field force-automation market, valued at 50.0, represents about 9.1% of the European market. The growth is driven by increasing investments in technology and a shift towards digital solutions in various sectors. Demand for automation in logistics and customer service is rising, supported by government initiatives aimed at enhancing digital infrastructure. Key cities like Madrid and Barcelona are significant markets, with a competitive landscape featuring both local and global players.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe market, valued at 36.95, captures approximately 6.7% of the overall European field force-automation sector. Growth drivers vary significantly across countries, influenced by local economic conditions and regulatory frameworks. Demand trends indicate a rising interest in automation solutions tailored to specific industries. The competitive landscape is fragmented, with local players often dominating, while international firms seek to expand their presence in niche markets.