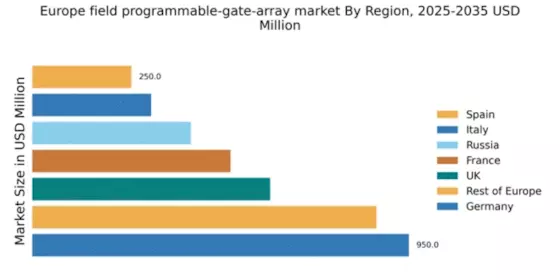

Germany : Strong industrial base drives growth

Key markets include cities like Munich, Stuttgart, and Berlin, which are hubs for automotive and technology industries. The competitive landscape features major players such as Xilinx, Intel, and Altera, all of which have significant operations in Germany. Local market dynamics are characterized by a strong emphasis on innovation and R&D, with applications spanning automotive, telecommunications, and industrial automation sectors. The business environment is favorable, supported by skilled labor and investment in technology.

UK : Innovation fuels market expansion

Key markets include London, Cambridge, and Manchester, known for their tech ecosystems and innovation hubs. The competitive landscape features major players like Xilinx and Intel, alongside numerous startups driving innovation. The local market dynamics are influenced by a collaborative environment between academia and industry, promoting sector-specific applications in telecommunications, automotive, and healthcare. The business environment is dynamic, with a strong emphasis on technology adoption and digital transformation.

France : Diverse applications drive growth

Key markets include Paris, Toulouse, and Lyon, which are centers for aerospace and technology industries. The competitive landscape features major players like Altera and Xilinx, with a growing presence of local firms. Local market dynamics are characterized by a focus on high-tech applications, particularly in aerospace and defense. The business environment is supportive, with government backing for technology initiatives and a skilled workforce driving innovation.

Russia : Strategic investments boost market

Key markets include Moscow and St. Petersburg, which are central to technological advancements and industrial development. The competitive landscape features both international players like Intel and local firms. Local market dynamics are influenced by government policies promoting technology adoption and innovation. The business environment is evolving, with increasing collaboration between public and private sectors to drive FPGA applications in defense and telecommunications.

Italy : Manufacturing sector drives growth

Key markets include Turin, Milan, and Bologna, which are hubs for manufacturing and technology. The competitive landscape features major players like Xilinx and Microsemi, alongside local firms. Local market dynamics are characterized by a focus on manufacturing applications, with increasing adoption of FPGAs in automotive and industrial sectors. The business environment is supportive, with government backing for technology initiatives and a skilled workforce driving innovation.

Spain : Emerging tech landscape fosters demand

Key markets include Madrid, Barcelona, and Valencia, which are central to technology and innovation. The competitive landscape features major players like Intel and Lattice Semiconductor, alongside local startups. Local market dynamics are characterized by a focus on smart city applications and telecommunications. The business environment is evolving, with increasing investment in technology and a collaborative approach between industry and academia driving FPGA adoption.

Rest of Europe : Varied applications drive regional growth

Key markets include cities across Scandinavia, the Benelux countries, and Eastern Europe, each with distinct industrial focuses. The competitive landscape features a mix of international players like Xilinx and local firms. Local market dynamics vary significantly, influenced by regional economic conditions and sector-specific applications. The business environment is diverse, with varying levels of technology adoption and innovation across different countries.