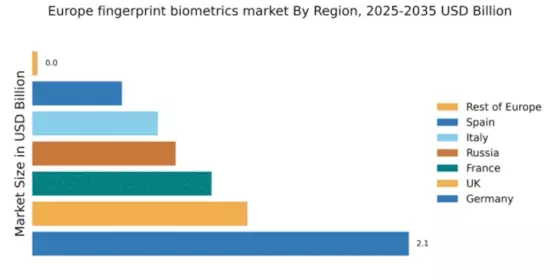

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 2.1 in the fingerprint biometrics sector, driven by robust demand in security and identification applications. Key growth drivers include increasing investments in smart city initiatives and stringent regulatory frameworks promoting biometric solutions. The government has implemented policies to enhance digital security, fostering a favorable environment for technology adoption. Infrastructure development, particularly in urban areas, supports the integration of biometric systems in public services and transportation.

UK : Innovation and Security Needs Propel Market

The UK boasts a market share of 1.2 in fingerprint biometrics, fueled by rising security concerns and technological advancements. Demand is particularly strong in sectors like finance and law enforcement, where biometric authentication is becoming standard. Government initiatives, such as the National Cyber Security Strategy, emphasize the importance of biometric solutions in enhancing national security. The UK's infrastructure is well-equipped to support these technologies, with significant investments in digital identity verification systems.

France : Regulatory Support and Innovation Drive Growth

France captures a market share of 1.0 in the fingerprint biometrics sector, supported by a strong regulatory framework and innovation in technology. The French government has initiated several programs to enhance public safety, which has increased the demand for biometric solutions in various sectors, including healthcare and public administration. The country's focus on digital transformation and smart city projects further drives consumption patterns, with a growing emphasis on secure identification methods.

Russia : Government Initiatives Fuel Market Growth

With a market share of 0.8, Russia's fingerprint biometrics market is on the rise, driven by government initiatives aimed at enhancing national security and public safety. The demand for biometric solutions is increasing in sectors such as banking and telecommunications, where secure identification is critical. Regulatory policies are evolving to support the integration of biometric technologies, while infrastructure improvements in urban areas facilitate wider adoption of these systems across various industries.

Italy : Cultural Heritage and Security Needs Align

Italy holds a market share of 0.7 in fingerprint biometrics, with growth driven by the need for enhanced security in cultural heritage sites and public services. The Italian government has launched initiatives to protect historical sites, integrating biometric solutions for visitor management and security. Demand is also rising in the banking sector, where biometric authentication is becoming essential. The competitive landscape features both local and international players, fostering innovation and collaboration.

Spain : Security Concerns Drive Market Growth

Spain's fingerprint biometrics market, with a share of 0.5, is experiencing accelerated growth due to increasing security concerns in both public and private sectors. The government has implemented policies to enhance digital identity verification, particularly in law enforcement and financial services. Key cities like Madrid and Barcelona are leading the way in adopting biometric technologies, supported by a competitive landscape that includes major players like IDEMIA and Thales, driving innovation and market expansion.

Rest of Europe : Diverse Needs Shape Market Dynamics

The Rest of Europe holds a minimal market share of 0.03 in fingerprint biometrics, yet it presents unique opportunities for growth. Various countries are beginning to adopt biometric solutions, driven by specific local needs such as border control and identity verification. Regulatory frameworks are gradually evolving to support these technologies, although infrastructure development remains a challenge. The competitive landscape is diverse, with both established players and new entrants vying for market share in niche applications.