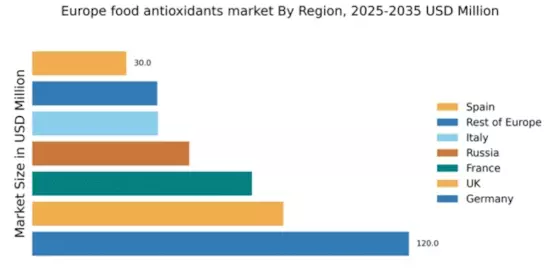

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant market share of 120.0 million USD, representing a significant portion of the European food antioxidants market. Key growth drivers include a rising health consciousness among consumers and increasing demand for natural preservatives. Regulatory policies favoring clean label products and sustainability initiatives further boost market potential. The country’s robust infrastructure and advanced industrial capabilities support the production and distribution of food antioxidants.

UK : Health Trends Shape Market Dynamics

The UK market for food antioxidants is valued at 80.0, reflecting a growing consumer preference for natural ingredients. Key growth drivers include increasing awareness of health benefits and regulatory support for clean label products. The demand for antioxidants is particularly strong in sectors like beverages and snacks, where consumers seek healthier options. Government initiatives promoting food safety and quality further enhance market growth.

France : Culinary Heritage Meets Modern Needs

France, with a market value of 70.0, showcases a unique blend of culinary tradition and innovation in food preservation. The growth is driven by the demand for high-quality, natural ingredients in gourmet foods. Regulatory frameworks support the use of antioxidants in food products, ensuring safety and quality. The French market is characterized by a strong emphasis on organic and artisanal products, aligning with consumer preferences for authenticity.

Russia : Expanding Food Sector Drives Growth

Russia's food antioxidants market, valued at 50.0, is on the rise due to an expanding food sector and increasing consumer awareness of health benefits. Key growth drivers include urbanization and a shift towards processed foods. Regulatory policies are evolving to support food safety and quality, creating a conducive environment for market growth. The demand for antioxidants is particularly strong in the meat and dairy sectors, where preservation is crucial.

Italy : Tradition Meets Health Consciousness

Italy's market for food antioxidants is valued at 40.0, driven by a rich culinary heritage that emphasizes quality ingredients. The growth is fueled by increasing consumer demand for health-oriented food products and regulatory support for natural additives. The Italian market is characterized by a strong presence of local producers and a focus on organic products, particularly in regions like Tuscany and Emilia-Romagna, known for their food excellence.

Spain : Natural Ingredients Gain Popularity

Spain's food antioxidants market, valued at 30.0, is experiencing growth driven by health trends and a preference for natural ingredients. The demand for antioxidants is particularly strong in the olive oil and wine sectors, where preservation is essential. Regulatory policies support the use of natural additives, enhancing market potential. The competitive landscape includes both local and international players, fostering innovation and quality in food products.

Rest of Europe : Regional Variations in Demand

The Rest of Europe, with a market value of 39.79, encompasses diverse markets with varying demand for food antioxidants. Growth drivers include increasing health awareness and regulatory support for food safety. Each country within this sub-region presents unique consumption patterns and preferences, influenced by local culinary traditions. The competitive landscape features a mix of local and international players, catering to specific regional needs and applications.