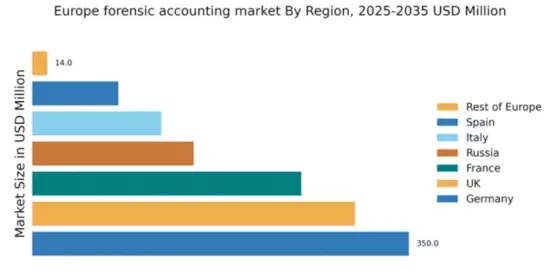

Germany : Strong market driven by regulations

Germany holds a dominant position in the European forensic accounting market, with a value of $350.0 million, representing approximately 35% of the total market share. Key growth drivers include stringent regulatory frameworks, increasing corporate governance demands, and a rising number of fraud cases. The government has implemented various initiatives to enhance transparency and accountability, further fueling demand for forensic services. Additionally, robust infrastructure and a well-developed industrial sector support the growth of this market.

UK : Diverse applications across sectors

The UK forensic accounting market is valued at $300.0 million, accounting for 30% of the European market. Growth is driven by increasing regulatory scrutiny, particularly in financial services and corporate sectors. Demand for forensic services is rising due to heightened awareness of fraud and financial misconduct. The UK government has introduced various compliance measures to strengthen corporate governance, which has positively impacted the market. The presence of advanced technological infrastructure also supports forensic investigations.

France : Regulatory reforms boost demand

France's forensic accounting market is valued at $250.0 million, representing 25% of the European market. Key growth drivers include recent regulatory reforms aimed at enhancing financial transparency and combating fraud. The demand for forensic accounting services is increasing, particularly in sectors like banking and insurance, where compliance is critical. Government initiatives to promote ethical business practices further stimulate market growth. The country's strong legal framework also supports the forensic accounting profession.

Russia : Growth amid regulatory changes

Russia's forensic accounting market is valued at $150.0 million, making up 15% of the European market. The growth is driven by ongoing regulatory changes and an increasing focus on corporate governance. Demand for forensic services is rising as businesses seek to mitigate risks associated with fraud and financial misconduct. The Russian government has introduced measures to enhance financial oversight, which has positively influenced the market. The development of key industries, such as energy and finance, also contributes to market expansion.

Italy : Focus on compliance and governance

Italy's forensic accounting market is valued at $120.0 million, accounting for 12% of the European market. Growth is driven by increasing regulatory requirements and a focus on corporate governance. The demand for forensic services is particularly strong in sectors like manufacturing and finance, where compliance is critical. The Italian government has implemented various initiatives to combat financial crime, which has positively impacted the market. Additionally, the country's industrial base supports the growth of forensic accounting services.

Spain : Regulatory focus enhances market growth

Spain's forensic accounting market is valued at $80.0 million, representing 8% of the European market. The growth is driven by increasing regulatory scrutiny and a rising awareness of financial fraud. Demand for forensic services is particularly strong in sectors such as real estate and finance, where compliance is essential. The Spanish government has introduced measures to enhance financial transparency, which has positively influenced the market. The development of key urban centers like Madrid and Barcelona also supports market growth.

Rest of Europe : Diverse opportunities across regions

The Rest of Europe forensic accounting market is valued at $14.0 million, accounting for 1% of the total market. Growth in this segment is driven by niche opportunities in various countries, where regulatory frameworks are evolving. Demand for forensic services is emerging in sectors like healthcare and technology, where financial integrity is increasingly prioritized. Local governments are beginning to implement measures to enhance financial oversight, which is expected to stimulate market growth. The competitive landscape is diverse, with several local players emerging.