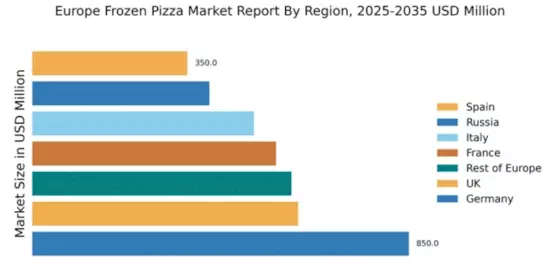

Germany : Strong Demand and Local Brands

Key markets include major cities like Berlin, Munich, and Hamburg, where consumer demand is particularly high. The competitive landscape features strong local players such as Dr. Oetker, alongside international brands like Nestle and General Mills. The market is characterized by a diverse range of product offerings, including gluten-free and organic options, catering to health-conscious consumers. The overall business environment is favorable, supported by a strong retail sector and increasing online sales channels.

UK : Convenience Meets Quality in Dining

Key markets include London, Manchester, and Birmingham, where demand for frozen pizza is particularly strong. The competitive landscape features major players like Kraft Heinz and General Mills, alongside local brands. The market is dynamic, with a growing trend towards premium and artisanal frozen pizzas. Retailers are increasingly focusing on product innovation to meet changing consumer preferences, creating a vibrant business environment.

France : Culinary Heritage Meets Convenience

Key markets include Paris, Lyon, and Marseille, where diverse consumer preferences drive demand. The competitive landscape features local brands and international players like Nestle and Dr. Oetker. The market is characterized by a focus on quality and authenticity, with many products reflecting regional flavors. The business environment is robust, supported by a strong retail sector and increasing online sales channels.

Russia : Growing Demand for Convenience Foods

Key markets include Moscow and St. Petersburg, where demand for frozen pizza is rapidly increasing. The competitive landscape features both local and international brands, with players like Schwan's Company and ConAgra Foods gaining traction. The market is evolving, with a growing interest in premium and health-oriented products. The business environment is becoming more favorable, supported by increasing retail opportunities and online sales growth.

Italy : Home of Pizza Embraces Frozen Options

Key markets include Rome, Milan, and Naples, where traditional pizza culture meets frozen innovations. The competitive landscape features local brands like Dr. Oetker and international players. The market is characterized by a focus on quality and authenticity, with many products reflecting regional flavors. The business environment is vibrant, supported by a strong retail sector and increasing online sales channels.

Spain : Convenience Food Trend on the Rise

Key markets include Madrid and Barcelona, where demand for frozen pizza is growing rapidly. The competitive landscape features both local and international brands, with players like Nestle and Dr. Oetker making significant inroads. The market is dynamic, with a focus on product innovation to meet evolving consumer preferences. The business environment is becoming more favorable, supported by a strong retail sector and increasing online sales channels.

Rest of Europe : Varied Preferences Across Regions

Key markets include cities across various countries, each with unique consumer preferences. The competitive landscape features a mix of local and international brands, with significant players like General Mills and Kraft Heinz. The market is characterized by a focus on product variety and innovation, catering to diverse tastes. The business environment is dynamic, supported by a growing retail sector and increasing online sales channels.