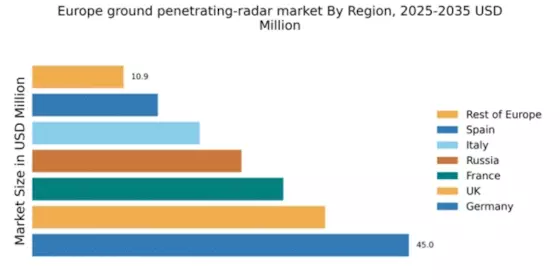

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, where construction and archaeological projects are prevalent. The competitive landscape features significant players such as GSSI and Geophysical Survey Systems Inc, which dominate the market with innovative solutions. Local dynamics are influenced by a strong emphasis on quality and precision in engineering applications. The construction and environmental sectors are primary users of GPR technology, driving demand for advanced systems.

UK : Infrastructure Projects Fueling Demand

Key markets include London, Manchester, and Birmingham, where urban development is rapidly evolving. The competitive landscape features major players like Radiodetection Ltd and Mala Geoscience, which are well-established in the region. Local market dynamics are characterized by a strong emphasis on compliance with safety regulations and environmental standards. The construction and archaeological sectors are significant consumers of GPR technology, driving innovation and adoption.

France : Diverse Applications Drive Growth

Key markets include Paris, Lyon, and Marseille, where urban infrastructure projects are prevalent. The competitive landscape features players like Sensors & Software Inc and Geometrics Inc, which are gaining traction in the region. Local dynamics are influenced by a growing emphasis on sustainability and compliance with EU regulations. The construction and environmental sectors are primary users of GPR technology, enhancing its adoption across various applications.

Russia : Infrastructure Development as a Catalyst

Key markets include Moscow, St. Petersburg, and Kazan, where urban development is accelerating. The competitive landscape features local players like Zond and international firms such as GSSI. Local market dynamics are shaped by a focus on technological advancements and compliance with safety regulations. The construction and archaeological sectors are significant consumers of GPR technology, driving its adoption in various applications.

Italy : Cultural Heritage Drives Demand

Key markets include Rome, Milan, and Florence, where cultural heritage projects are prevalent. The competitive landscape features players like Mala Geoscience and Geometrics Inc, which are well-positioned in the region. Local dynamics are influenced by a strong emphasis on preserving historical sites and compliance with EU regulations. The archaeological and construction sectors are primary users of GPR technology, enhancing its adoption across various applications.

Spain : Infrastructure Growth and Innovation

Key markets include Madrid, Barcelona, and Valencia, where urban development is rapidly evolving. The competitive landscape features players like Sensors & Software Inc and Radiodetection Ltd, which are gaining traction in the region. Local market dynamics are characterized by a strong emphasis on compliance with safety regulations and environmental standards. The construction and environmental sectors are significant consumers of GPR technology, driving innovation and adoption.

Rest of Europe : Varied Market Dynamics and Growth

Key markets include cities in Scandinavia, Eastern Europe, and the Benelux region, where urban infrastructure projects are prevalent. The competitive landscape features a mix of local and international players, including GSSI and Geometrics Inc. Local dynamics are influenced by varying regulatory environments and market conditions. The construction and archaeological sectors are primary users of GPR technology, enhancing its adoption across various applications.

Leave a Comment