Shift Towards Hybrid Storage Solutions

The hard disk market in Europe is witnessing a shift towards hybrid storage solutions, combining traditional hard disk drives (HDDs) with solid-state drives (SSDs). This trend is driven by the need for improved performance and cost-effectiveness in data storage. Hybrid solutions allow organizations to leverage the high capacity of HDDs while benefiting from the speed of SSDs for frequently accessed data. As businesses seek to optimize their storage infrastructure, the adoption of hybrid systems is likely to increase. In 2025, it is anticipated that hybrid storage solutions will account for approximately 30% of the total storage market in Europe, indicating a significant shift in consumer preferences within the hard disk market.

Growing E-commerce and Digital Services

The hard disk market in Europe is positively impacted by the rapid growth of e-commerce and digital services. As online retail and digital platforms expand, the demand for reliable storage solutions to support these services is increasing. E-commerce businesses require robust data storage systems to manage customer information, transaction records, and inventory data. In 2025, the European e-commerce market is projected to reach €500 billion, further driving the need for efficient hard disk solutions. This growth presents opportunities for the hard disk market to cater to the storage needs of e-commerce platforms, thereby enhancing their operational efficiency and data management capabilities.

Regulatory Compliance and Data Security

The hard disk market in Europe is also shaped by stringent regulatory compliance and data security requirements. With regulations such as the General Data Protection Regulation (GDPR) in place, organizations are mandated to ensure the security and integrity of sensitive data. This has led to an increased focus on hard disk solutions that offer enhanced security features, such as encryption and secure data erasure. As businesses strive to comply with these regulations, the demand for reliable and secure storage solutions is expected to rise. In 2025, the market for secure hard disk solutions in Europe is projected to grow by approximately 6%, reflecting the increasing emphasis on data protection and compliance within the hard disk market.

Increasing Data Generation and Storage Needs

The hard disk market in Europe is significantly influenced by the exponential growth of data generation across various sectors. With the rise of big data analytics, IoT devices, and digital transformation initiatives, organizations are compelled to invest in robust storage solutions. In 2025, it is estimated that the total data generated in Europe will reach approximately 50 zettabytes, necessitating efficient storage systems. This surge in data volume is driving demand for high-capacity hard disks, as businesses seek to store and manage their data effectively. Consequently, the hard disk market is likely to see a substantial increase in sales, as companies prioritize scalable storage solutions to accommodate their expanding data requirements.

Technological Advancements in Storage Solutions

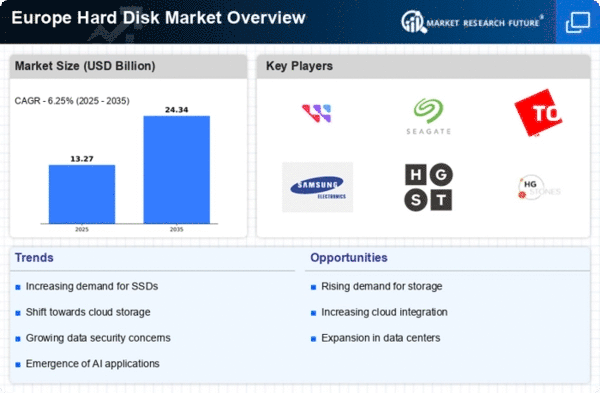

The hard disk market in Europe is experiencing a notable transformation due to rapid technological advancements. Innovations in data storage technologies, such as the development of shingled magnetic recording (SMR) and heat-assisted magnetic recording (HAMR), are enhancing storage capacities and performance. These advancements are crucial as they allow manufacturers to produce hard disks with higher data densities, which is increasingly demanded by enterprises for data-intensive applications. Furthermore, the European market is projected to grow at a CAGR of approximately 5.2% from 2025 to 2030, driven by the need for efficient data management solutions. As organizations continue to generate vast amounts of data, the hard disk market must adapt to these technological changes to meet evolving consumer needs.