Growing Demand in Optical Applications

The high purity-quartz-sand market is experiencing a growing demand for high purity quartz in optical applications, including lenses and fiber optics. The increasing use of high-quality optical components in telecommunications and consumer electronics is driving this trend. As Europe continues to invest in advanced communication technologies, the need for high purity quartz is expected to rise. The optical market in Europe is projected to reach €15 billion by 2026, with high purity quartz playing a pivotal role in meeting the stringent quality requirements of optical products. This demand is likely to propel the high purity-quartz-sand market forward, as manufacturers adapt to the evolving needs of the optical sector.

Expansion of Semiconductor Manufacturing

The high purity-quartz-sand market is poised for growth due to the expansion of semiconductor manufacturing in Europe. As the demand for electronic devices continues to rise, the semiconductor industry is increasingly reliant on high purity quartz for the production of silicon wafers. In 2025, the European semiconductor market is expected to reach €100 billion, with a significant portion of this growth attributed to advancements in technology and increased production capacity. This expansion necessitates a steady supply of high purity quartz, thereby driving demand within the high purity-quartz-sand market. The strategic importance of semiconductors in various sectors, including automotive and telecommunications, further underscores the potential for growth in this market.

Increasing Applications in Renewable Energy

The high purity-quartz-sand market is experiencing a notable surge in demand due to its critical role in the renewable energy sector. High purity quartz is essential for manufacturing photovoltaic cells used in solar panels, which are increasingly adopted across Europe. The European Union's commitment to achieving carbon neutrality by 2050 has led to a significant investment in renewable energy technologies. As a result, the demand for high purity quartz in solar energy applications is projected to grow, potentially reaching a market value of €1 billion by 2027. This trend indicates a robust growth trajectory for the high purity-quartz-sand market, driven by the transition towards sustainable energy solutions.

Regulatory Support for High Purity Materials

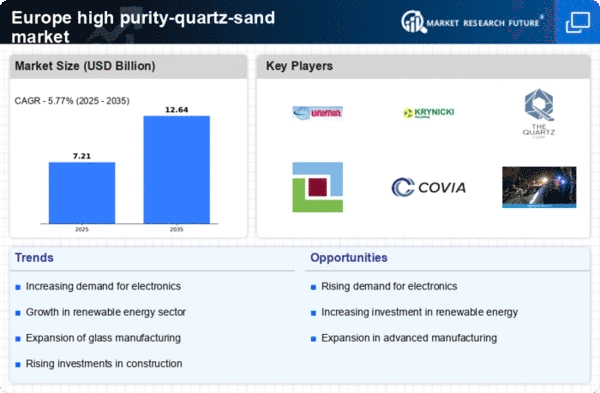

The high purity-quartz-sand market benefits from increasing regulatory support aimed at promoting the use of high purity materials in various applications. European regulations are increasingly favoring the use of high-quality raw materials to enhance product performance and sustainability. For instance, the European Commission's initiatives to reduce environmental impact and promote circular economy practices are likely to bolster the demand for high purity quartz in industries such as glass manufacturing and electronics. This regulatory environment may lead to a projected growth rate of 5% annually for the high purity-quartz-sand market, as manufacturers seek to comply with stringent quality standards and consumer preferences for sustainable products.

Technological Innovations in Mining and Processing

The high purity-quartz-sand market is witnessing advancements in mining and processing technologies that enhance the quality and efficiency of quartz extraction. Innovations such as advanced sorting techniques and purification processes are enabling producers to obtain higher purity levels, which are crucial for applications in electronics and optics. As the demand for high purity quartz continues to rise, these technological improvements are expected to increase production capacity and reduce costs. The European market for high purity quartz is projected to grow at a CAGR of 6% over the next five years, driven by these innovations that improve the overall competitiveness of the high purity-quartz-sand market.