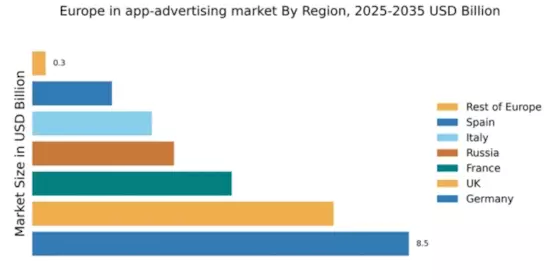

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 8.5% market share in the European in-app advertising sector, valued at approximately €1.2 billion. Key growth drivers include a robust digital economy, high smartphone penetration, and increasing consumer spending on mobile applications. Regulatory support from the Federal Network Agency promotes fair competition, while initiatives like the Digital Strategy 2025 aim to enhance digital infrastructure and innovation across the country.

UK : Innovation and Consumer Engagement Focus

Key markets include London, Manchester, and Birmingham, where a vibrant startup ecosystem thrives. Major players like Google and Facebook dominate, but local firms are emerging. The competitive landscape is characterized by innovation, with a focus on sectors like gaming and e-commerce, driving demand for targeted advertising solutions.

France : Cultural Diversity Drives Engagement

Key markets include Paris, Lyon, and Marseille, where tech innovation is thriving. Major players like Apple and Unity Technologies have a significant presence, competing with local firms. The competitive landscape is dynamic, with a focus on sectors like travel and retail, where personalized advertising is becoming essential.

Russia : Regulatory Landscape Shapes Dynamics

Moscow and St. Petersburg are key markets, with a competitive landscape featuring both international and local players. Companies like InMobi and AdColony are gaining traction, focusing on sectors like gaming and social media. The business environment is evolving, with a growing emphasis on localized content and targeted advertising.

Italy : Cultural Richness Fuels Engagement

Key markets include Milan, Rome, and Florence, where a mix of international and local players compete. Major companies like Facebook and Amazon are present, alongside emerging local startups. The competitive landscape is characterized by a focus on sectors like retail and travel, where engaging advertising strategies are crucial.

Spain : Mobile Usage Drives Advertising Growth

Key markets include Madrid and Barcelona, where a mix of local and international players thrive. Companies like Google and IronSource are significant players, focusing on sectors like entertainment and e-commerce. The competitive landscape is dynamic, with a growing emphasis on personalized advertising solutions.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include smaller nations like Portugal and the Nordic countries, where local players are emerging. The competitive landscape is characterized by niche players focusing on specific sectors, such as travel and local services. The business environment is evolving, with a growing emphasis on tailored advertising strategies.