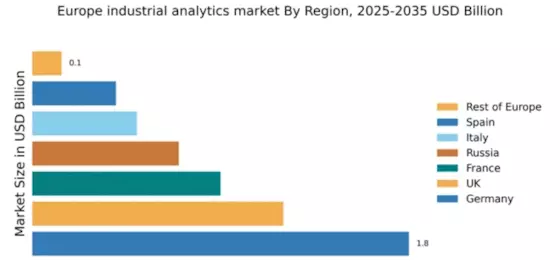

Germany : Innovation and Infrastructure Drive Growth

Germany holds a dominant market share of 1.8 in the industrial analytics sector, driven by robust manufacturing and engineering capabilities. Key growth drivers include the push for Industry 4.0, increasing automation, and a strong focus on data-driven decision-making. Government initiatives, such as the Digital Strategy 2025, aim to enhance digital infrastructure, while stringent regulations ensure data security and compliance. The demand for predictive maintenance and operational efficiency is on the rise, reflecting a shift towards smart manufacturing.

UK : Innovation Fuels Industrial Analytics Growth

The UK boasts a market share of 1.2 in industrial analytics, supported by a vibrant tech ecosystem and significant investments in AI and IoT. Key growth drivers include the increasing need for operational efficiency and real-time data analytics. The UK government has launched initiatives like the Industrial Strategy Challenge Fund to promote innovation. Demand is particularly strong in sectors such as manufacturing, energy, and transportation, reflecting a growing trend towards data-centric operations.

France : Government Support and Innovation Thrive

France's industrial analytics market holds a share of 0.9, bolstered by government support for digital transformation and innovation. The French government has initiated programs like the 'France 2030' plan, which aims to enhance industrial competitiveness through digital technologies. Demand trends indicate a rising interest in smart factories and data analytics solutions across various sectors, including automotive and aerospace, driven by the need for efficiency and sustainability.

Russia : Industrial Analytics on the Rise

Russia's industrial analytics market is valued at 0.7, with growth driven by modernization efforts in key industries such as oil and gas, manufacturing, and utilities. Government initiatives aimed at digitalization and infrastructure development are crucial for market expansion. However, regulatory challenges and geopolitical factors may impact foreign investments. Cities like Moscow and St. Petersburg are central to this growth, with local players increasingly adopting advanced analytics solutions.

Italy : Manufacturing Renaissance Through Data

Italy's market share in industrial analytics stands at 0.5, with a focus on revitalizing its manufacturing sector. Key growth drivers include the push for digital transformation and the adoption of smart manufacturing practices. Government initiatives, such as the 'Industry 4.0 Plan,' support investments in technology and innovation. Regions like Lombardy and Emilia-Romagna are pivotal, with major players like Siemens and SAP enhancing their presence in the local market.

Spain : Investment and Innovation Drive Growth

Spain's industrial analytics market is valued at 0.4, with significant potential for growth driven by increased investments in technology and innovation. The Spanish government has launched initiatives to promote digitalization across industries, particularly in manufacturing and energy. Demand for analytics solutions is rising, especially in regions like Catalonia and Madrid, where local companies are increasingly adopting data-driven strategies to enhance operational efficiency.

Rest of Europe : Regional Dynamics Shape Analytics Landscape

The Rest of Europe accounts for a market share of 0.14 in industrial analytics, characterized by diverse market dynamics across various countries. Growth drivers include regional government initiatives aimed at enhancing digital infrastructure and promoting innovation. Demand trends vary significantly, with some countries focusing on manufacturing while others emphasize services. Local players are increasingly collaborating with global firms to leverage advanced analytics solutions tailored to specific regional needs.

Leave a Comment