Shift Towards Decentralized Energy Systems

The industrial boilers market in Europe is witnessing a shift towards decentralized energy systems, which is reshaping energy consumption patterns. This trend is characterized by the increasing adoption of localized energy generation, such as combined heat and power (CHP) systems. These systems allow industries to generate their own energy, thereby reducing reliance on centralized power grids. The European Union's commitment to promoting decentralized energy solutions is likely to drive the demand for industrial boilers that can integrate with these systems. As industries seek to enhance energy security and reduce costs, the adoption of decentralized energy solutions is expected to gain momentum, positively impacting the industrial boilers market.

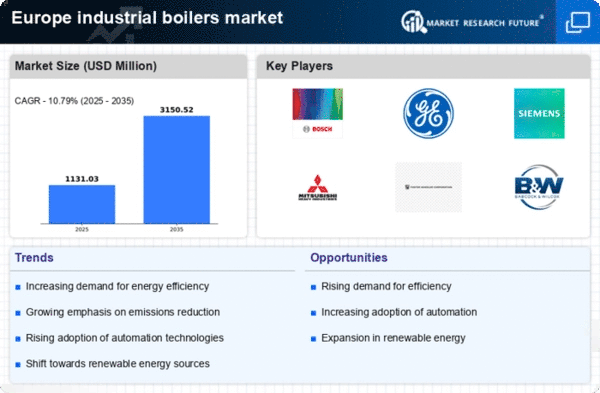

Rising Energy Costs and Demand for Efficiency

In the context of the industrial boilers market in Europe, rising energy costs are a significant driver. As energy prices continue to escalate, industries are compelled to seek solutions that enhance energy efficiency. The demand for high-efficiency boilers is surging, as these systems can substantially reduce operational costs. According to recent data, energy-efficient boilers can lower energy consumption by up to 30%, translating into significant savings for businesses. This trend is particularly pronounced in sectors such as manufacturing and food processing, where energy costs constitute a large portion of operational expenses. Consequently, the pursuit of cost-effective energy solutions is likely to stimulate growth in the industrial boilers market.

Industrial Growth and Infrastructure Development

The industrial boilers market in Europe is experiencing growth driven by robust industrial expansion and infrastructure development. As various sectors, including manufacturing, pharmaceuticals, and food processing, continue to expand, the demand for reliable steam and heating solutions increases. The European Commission's investment in infrastructure projects, estimated at €1 trillion over the next decade, is expected to further boost the market. This investment will likely lead to increased installations of industrial boilers, as industries require efficient heating systems to support their operations. The interplay between industrial growth and infrastructure development is anticipated to create a favorable environment for the industrial boilers market.

Regulatory Compliance and Environmental Standards

The industrial boilers market in Europe is increasingly influenced by stringent regulatory compliance and environmental standards. Governments are implementing policies aimed at reducing greenhouse gas emissions and promoting energy efficiency. For instance, the European Union has set ambitious targets to cut emissions by at least 55% by 2030 compared to 1990 levels. This regulatory landscape compels industries to adopt cleaner technologies, thereby driving demand for advanced industrial boilers that meet these standards. As a result, manufacturers are focusing on developing boilers that not only comply with regulations but also enhance operational efficiency. The need for compliance is expected to propel the market, as industries seek to avoid penalties and improve their sustainability profiles.

Focus on Sustainability and Corporate Responsibility

In the industrial boilers market in Europe, there is a growing emphasis on sustainability and corporate responsibility. Companies are increasingly recognizing the importance of adopting environmentally friendly practices to enhance their brand image and meet consumer expectations. This shift is prompting industries to invest in sustainable boiler technologies that minimize environmental impact. For instance, the use of biomass and waste heat recovery systems is gaining traction as companies strive to reduce their carbon footprint. The European market is likely to see a rise in demand for industrial boilers that align with sustainability goals, as businesses aim to demonstrate their commitment to corporate social responsibility.